A look at the average returns of bonds over the last 30 years does not suggest that equity returns have really been worth the risk. Table 1 shows the returns on Australian Bonds (Aust Comm Bank All Series/All Maturities) versus the accumulated return of the Australian sharemarket (S&P/ASX 200 TR) and whilst equities have the better performance …

Tag Archive: equities

Feb 10

Don’t forget the E in PE

Source: RBA The above left chart, Forward PE Ratio, shows that the Australian sharemarket is potentially relatively cheap at the moment. The forward PE ratio, which is the ‘current price’ of the Australian sharemarket divided by forward estimates of earnings, has only been lower during the GFC and the 1990-91 recession ‘we had to have’. …

Feb 07

A little bit of Bond misinformation

I was just reading the latest riveting story on bonds in this month’s Asset magazine and I feel compelled to share an example of misinformation that tends to annoy me a little (I know its probably a little pathetic but anyway)…John O’Brien, van Eyk – Head of Research, apparently said that many of the great …

Feb 02

ASX200 to go through 5000!!!

Perhaps haven’t been reading enough but I’ve just read my first article of the year with a fund manager suggesting huge returns for the Australian sharemarket…click here. Apparently the Platypus CIO believes the ASX200 ‘looks set to finish 2012 over the 5000 mark”. At last check the ASX today was 4267 so ifit grows to …

Jan 29

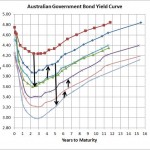

Australian Government Bond Yields…continue slight improvement

Source: RBA Its been a few weeks since I provided an update on the local government yield curve and consistent with the slight improvement in the sharemarket the Australian Government Bond Yield Curve has indicated a better outlook for the local economy. As the chart shows, since 6 January the yield curve has increased around …

Jan 25

Managing Market Risk using Variable Beta Funds

Lonsec have a reasonable investment strategy paper released today (subscription required) suggesting one of the best ways of managing equity market risk is to use variable beta managers. A variable beta manager is a manager who has the ability to significantly change their exposure to the market depending on their view. So if a variable …

Jan 19

“Market Neutral Strategies as part of the Equity Allocation”…huh???

I read the following comment this morning in the Money Management daily enews…Market Neutral Funds Underrated: Zenith… There is demonstrable portfolio improvement to be had from allocating to market neutral strategies as part of the equity allocation… That says to me that if you want to improve your equities part of the portfolio then replace …

Jan 14

Buy-hold strategy may have had its day…I don’t think so

Page 31 of the Australian Financial Review (AFR) today has an article suggesting “that the traditional buy-hold approach to owning shares is dead”…full text, with subscription can be found here. The article’s stated reason for buy-hold is that “in the long run, markets always go up and will provide investors with a good return on …

Nov 24

Australian Government Bond Yields…seriously low

Source: RBA Just when you think the yield curve can’t get any lower, the last 8 days have taken another 10 to 15bps off. Sharemarkets have obviously dropped on the Euro-debacle and this yield curve demonstrates not only significant interest rate reductions in the months to come but a significantly slowing Australian eonomy thanks to …

Oct 07

Australian Government Bond Yield Curve…not much change

I don’t really have too much to say on this as nothing has really changed too significantly…the market is expecting interest rate cuts with an economy influenced by overseas events. The uncertainty in markets remains huge and its difficult to feel bullish on sharemarkets or the global economy and the downside risks clearly remain as nothing is resolved. …