Its been a while since I put some of my broader investment thoughts in writing and I’ve just written almost 4000 words to satisfy that…so it also sort of makes up for my lack of posting. So below is a lot of what I have written and hopefully its readable for anyone interested…I actually haven’t …

Tag Archive: equities

Aug 02

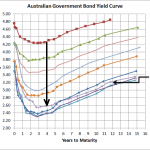

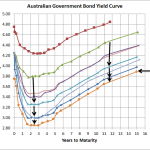

Australian Government Bond Yield Curve…slight increase but risks remain

Source:RBA The above chart shows that over the last few weeks there has been an increase of around 10-25bps across the yield curve which is also in line with the marginally stronger equity markets. As I’ve stated numerous times before, the European situation is what is currently driving most major market moves and the partial …

Jun 27

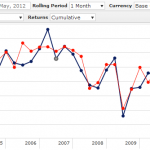

Australian Equities Style Investing – Value vs Growth

Its been over a week since I posted so I thought I’d write about something that is a little bit different and hopefully may provide a little bit of food for thought. The above chart shows the performance of the MSCI Australia Value index (dominated by low PE stocks) vs MSCI Australia Growth index (dominated …

Jun 10

Infrastructure in an investment portfolio…diversification benefits?

Recent years has seen increased interest in infrastructure being included in investment portfolios. The justification goes that, infrastructure assets provide steady income streams linked to inflation from large, often monopoly assets (like toll roads, airports and the like), with long lifetimes that can reduce the capital volatility. As the following ten year chart shows, global infrastructure (represented …

May 30

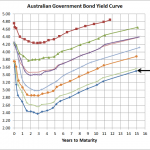

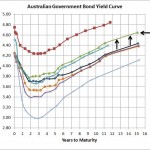

Australian Government Bond Yields…setting new records

Source: RBA I know I’ve written more posts on the Australian Government Bond Yield than ever but with the yield curve hitting record lows its pretty hard to ignore. The above chart shows where the yields finished yesterday and today they’re lower again. The European situation is definitely the main driver as funds move to …

May 18

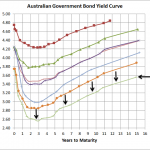

Australian Government Bond Yields…continue record lows

Source: RBA In less than 2 weeks the Australian Government Bond yield curve has dropped another 20bps plus and since August last year, the yield curve has dropped around 160bps on average…which means for bond fund owners double digit returns over the previous 12 months continue. Obviously the main reason for this drop in yield …

May 07

Australian Government Bond Yields…supports the dumb budget

Source: RBA As the above chart shows, the yield curve has dropped 70 to 90bps for all terms since March 19. With a 3 year bond yield just above 2.80%, which is close to where it was during the worst of the GFC, its pretty obvious markets aren’t too confident in the strength of our …

Mar 28

Bonds…the best protection from risky markets

Source: van Eyk The above chart shows the 12 month correlation of monthly returns between the UBS Composite index (representing Australian Fixed Interest) and the total return of the S&P/ASX All Ordinaries index (Australian shares). As you can see the correlation between both asset classes is extremely variable and the trendline shows that over the last …

Mar 20

Australian Government Bond Yields…approaching normal

Well…not normal yet. The shorter part of the curve suggests the market is expecting another two 25bps cuts by the RBA but with the Euro sovereign crisis well and truly looking much better its highly unlikely there’ll be any cuts soon. Whilst there’s plenty of evidence that shows the Euro sovereign crisis has improved, nothing …

Mar 10

SPIVA…Australian Small Cap managers demonstrate skill

The SPIVA report was released a few days ago and as I’ve mentioend before it is my favourite assessment of the success of fund managers because it takes into consideration survivorship bias…in other words, if you want to know who are the best fund managers over the last year, then you start with all fund …