The biggest market in the world, often represented by the S&P 500 index, crashed pretty quickly from 24 February reaching its bottom on 23 March. This fall, in US Dollars, was around 34%. Since then, it has bounced back by around 25% after almost 5 weeks … not a bad turnaround, but obviously not back …

Category Archive: Economy

Mar 19

RBA announces 3yr target of 0.25% and drops cash to 0.25% … & a very strange yield curve

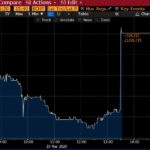

Reaction to 3 year bond price in the first chart below … that’s still a 0.5% yield to maturity. So the RBA are saying they want 0.25% yield to maturity which is a high bond price but only little bit of interest in the first 5 minutes or so off the bat. Source: Bloomberg A …

Mar 19

Most markets are mostly efficient most of the time … maybe not so much now

Its clearly been a long time since I updated this blog and perhaps this current crisis makes most sense to make a comeback; particularly given I started this blog not long after the worst of the GFC (Jan 2009 to be precise). Anyway, the current crisis has clearly required a global response to slow down …

Feb 13

Economic Growth & Sharemarket Returns … looking for relationships

Background According to (Elroy Dimson, 2010) the “conventional view Is that, over the long run, corporate earnings will constitute a roughly constant share of national income, and so dividends out to grow at a similar rate to the overall economy. This suggests that fast-growing economies will experience higher growth in real dividends, and hence higher …

Feb 07

Some Simplisitic Australian Market Analysis … setting a forecast baseline and a few trend-lines

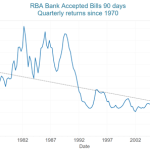

Like all economies, the Australian economy is always facing significant challenges. Since 1970 there has been the 1973 oil crisis and double digit inflation of the 1970s, the 1980-81 recession, further high inflation of the 1980s, crash of 1987, the recession we had to have in 1991, Asian crisis of 1998, global tech crash from …

Feb 21

A few simple thoughts on a few not so simple markets

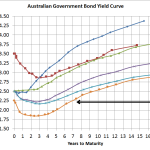

Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

Oct 11

Australian Bonds and Equities…who would’ve thought?

Source: Morningstar Direct, Delta Research & Advisory Over the last 5 years their performance has been pretty much the same…with the obvious exception that equities has bee a much much wilder ride. The reality of bonds in this global economy is that the outlook is still not that great from the major players (US, Japan, …

Aug 07

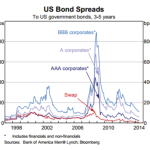

The disappearing credit spread…US now at pre-GFC levels

Source: RBA I know this probably an overly simplistic way of looking at investment grade credit markets…but…the above chart is currently showing that US investment Grade credit spreads have declined to be in the ballpark of pre-GFC levels. Personally, the US economy is still relatively weak, albeit getting stronger, but I no longer believe this …

May 16

Australian Bond Yield Curve…small budget led drop

Source: RBA, Delta Research & Advisory At the e shorter end of the yield curve there hasn’t been a great deal of change. This is completely expected whilst the RBA has signaled its intention to maintain its cash rate at 2.5% for some time and, whilst not easy to tell, this yield curve suggests it …