The above interactive chart shows what the latest crisis events have invoked on the Aussie dollar. At the time of writing trading around $0.57US which is down from a high in July 2011 around $1.10US … so almost half. Unfortunately for our currency this is what happens when crises occur … investors run to the …

Monthly Archive: March 2020

Mar 19

RBA announces 3yr target of 0.25% and drops cash to 0.25% … & a very strange yield curve

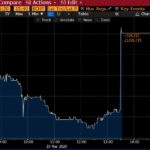

Reaction to 3 year bond price in the first chart below … that’s still a 0.5% yield to maturity. So the RBA are saying they want 0.25% yield to maturity which is a high bond price but only little bit of interest in the first 5 minutes or so off the bat. Source: Bloomberg A …

Mar 19

Most markets are mostly efficient most of the time … maybe not so much now

Its clearly been a long time since I updated this blog and perhaps this current crisis makes most sense to make a comeback; particularly given I started this blog not long after the worst of the GFC (Jan 2009 to be precise). Anyway, the current crisis has clearly required a global response to slow down …