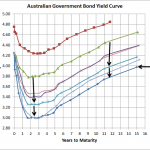

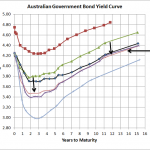

Source: RBA I know its just a week and a half since I last provided an Australian Government Bond Yield curve update but over this time the curve has dropped another 20-25bps to mostly be below the bottom from 19th December. This is largely on the back of weak inflation data…deflation if you look at the seasonally …

Monthly Archive: April 2012

Apr 24

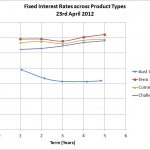

No wonder Term Deposits are popular…annuities too

Source: RBA, Comminsure, Challenger Life, RimSec The above chart is pretty strong evidence as to why investors are placing their money into term deposits and annuities…very very attractive margins over government bonds. As you can see, at the 5 year term the interest rates for term deposits and annuities are almost double! When you consider that …

Apr 22

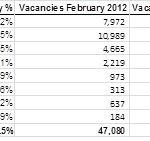

People appear to be choosing rent over property purchase

Following is a press release from SQM Research that was released last night. It pretty much says it all…residential vacancies relatively stable month on month and up a tiny bit year on year. Perth appears to be a rental concern with very few vacancies whilst Melbourne has the highest vacancy rate in Australia. Figures released …

Apr 19

Australian Government Bond Yields…heading south again

Source: RBA The above chart shows that bond yields shows that after bond yields reached a high around 1 month ago they have declined across all terms by around 50bps. That means that most of the traditional bond funds would have produced capital gains of around 2% over that last month (because the duration od …

Apr 16

Retirement Income Portfolios – poorly understood

One of the debates in the financial services media has been around the investment strategy of superannuation funds and whether they are holding too many equities. In the camp of too many equities is former Head of Treasury, Ken Henry, nd former Chairman of the Future Fund, David Murray; and opposing views have typically been …

Apr 08

Bad economic data is underway

Source: www.zerohedge.com Earlier in the week Zero Hedge showed the above chart and unfortunately there maybe something to it as it appears the outlook may be deteriorating. Whilst policymakers haven’t started to dither in obvious ways at the moment, with the Spanish government announcing increased austerity measures which will only make their economy worse, there …

Apr 02

Australian Government Bond Yields…a rate cut suggestion?

Source: RBA In less than two weeks the yield curve managed to drop around 15bps back to levels similar to those of late January. This is despite slightly stronger equity markets, the ASX200 made it through the 4,300 barrier for the first time in many months, and not that much in the way of really bad news…I …