I’m always fascinated by the various changes in financial market behaviour and this economic lockdown has created some new behaviours in the cash or money markets not seen before (or that I’m aware of). The chart below shows the performance of 3 cash benchmarks: RBA Cash Rate Target … currently 25bps (Green) RBA Cash Overnight …

Category Archive: Fixed Interest

Mar 19

RBA announces 3yr target of 0.25% and drops cash to 0.25% … & a very strange yield curve

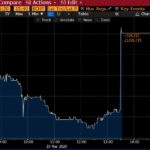

Reaction to 3 year bond price in the first chart below … that’s still a 0.5% yield to maturity. So the RBA are saying they want 0.25% yield to maturity which is a high bond price but only little bit of interest in the first 5 minutes or so off the bat. Source: Bloomberg A …

Mar 19

Most markets are mostly efficient most of the time … maybe not so much now

Its clearly been a long time since I updated this blog and perhaps this current crisis makes most sense to make a comeback; particularly given I started this blog not long after the worst of the GFC (Jan 2009 to be precise). Anyway, the current crisis has clearly required a global response to slow down …

Jun 20

Market Inflation Expectations…lower than RBA

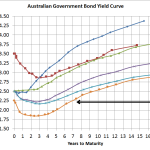

The above chart shows the yields for Australian Government Bonds, both nominal bonds and indexed bonds, as at the end of last week (although you can adjust the pricing date to any trading day of 2016). A simple way to determine the market’s inflation expectations over different timeframes is to simply subtract the difference. If …

Feb 21

A few simple thoughts on a few not so simple markets

Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

Oct 11

Australian Bonds and Equities…who would’ve thought?

Source: Morningstar Direct, Delta Research & Advisory Over the last 5 years their performance has been pretty much the same…with the obvious exception that equities has bee a much much wilder ride. The reality of bonds in this global economy is that the outlook is still not that great from the major players (US, Japan, …

Sep 27

Bill Gross leaves PIMCO…might lead to a downgrade or two

Irrespective of the quality of the rest of the firm, and there is a lot of quality, with the departure of Mohammed El Erian at the start of the year and now Bill Gross, it doesn’t take much to guess there may be a little destabilisation at the PIMCO offices for a while. Whilst Bill …

Aug 07

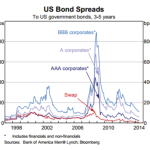

The disappearing credit spread…US now at pre-GFC levels

Source: RBA I know this probably an overly simplistic way of looking at investment grade credit markets…but…the above chart is currently showing that US investment Grade credit spreads have declined to be in the ballpark of pre-GFC levels. Personally, the US economy is still relatively weak, albeit getting stronger, but I no longer believe this …

Jun 14

Market Cap Weighted Bond Indices…always tough to beat

The common criticism of market-cap weighted bond indices is that they are inefficient because they are obviously weighted towards those with the most debt. Thus indicating that the index potentially carries more risk than necessary, or than we may want in a portfolio, because those with the most debt carry greater default risk than those with very …

May 16

Australian Bond Yield Curve…small budget led drop

Source: RBA, Delta Research & Advisory At the e shorter end of the yield curve there hasn’t been a great deal of change. This is completely expected whilst the RBA has signaled its intention to maintain its cash rate at 2.5% for some time and, whilst not easy to tell, this yield curve suggests it …