I’m in New York on an investment researcher’s conference and will be back in the coming days and hopefully will restart posting again! Had a good session a few days ago with a great presentation on how low volatility stocks have produced outstanding long run investment returns over many years…should be an index product on …

Monthly Archive: July 2012

Jul 19

Alternative equity an alternative to cash???

Oh dear. I just read the above headline in the Money Management daily…click here…and the stated reason is… they deliver reliable income streams and protect capital in volatile markets …I don’t think so or more to the point, with no where near the ability of cash. It looks like the S&P analyst is referring to …

Jul 10

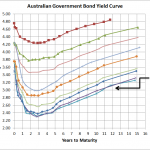

Australian Government Yield Curve…little change recently

Source: RBA Its been a few weeks since I posted my last Australian bond yield curve but nothing’s really changed. I guess its even true when it comes to the economics of the world…China’s data is mixed and not as strong as once expected; US continues to produce mixed data including more weak employment data; …

Jul 08

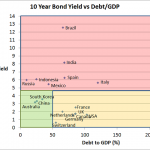

Sovereign Bond Allocation

Chart 1 Source: Trading Economics The above chart shows the 10 year bond yield versus the Debt/GDP of the 10 largest countries in the world by GDP (Except Turkey whose bond data is missing). The chart is divided into 3 sections… Red section…countries with high 10 year bond yields Orange section…high debt levels but low …