What a fascinating investment world its been over the past few months. We’ve had concerns about Greece exiting the Euro, commodity price crashes, a Chinese sharemarket crash and now some of the biggest developed economy sharemarket declines since the dark days of the GFC. Volatility has been somewhat benign for a long time thanks to …

Tag Archive: Government Bonds

Feb 21

A few simple thoughts on a few not so simple markets

Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

Oct 11

Australian Bonds and Equities…who would’ve thought?

Source: Morningstar Direct, Delta Research & Advisory Over the last 5 years their performance has been pretty much the same…with the obvious exception that equities has bee a much much wilder ride. The reality of bonds in this global economy is that the outlook is still not that great from the major players (US, Japan, …

May 16

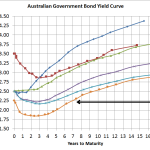

Australian Bond Yield Curve…small budget led drop

Source: RBA, Delta Research & Advisory At the e shorter end of the yield curve there hasn’t been a great deal of change. This is completely expected whilst the RBA has signaled its intention to maintain its cash rate at 2.5% for some time and, whilst not easy to tell, this yield curve suggests it …

Jan 13

Longer duration looking less risky…relatively speaking

Source: RBA & Delta Research & Advisory Its definitely been a long time since I posted anything and hopefully this post will at least be a little interesting…I haven’t read a great deal of anything financial over the past few weeks so I apologise if this is old news….but I digress!! Now, the above chart …

Oct 21

Australian Government Bond Yields…little change in a month but…

Source: RBA & Delta Research & Advisory The above chart shows very little change in Australian Government Bond yields over the last month which given what’s been happening in the US seems a little surprising. We’ve had massive fund managers losing confidence in the US Government and selling out of Treasury bonds and there …

Sep 23

RimSec September Research Report

This was written last week so is only a couple of days old so here is the RimSec monthly research report for those who are interested. Click here to download. There is the usual commentary on interest rates, the economy, and market expectations. The final article is a small piece on what is happening and …

Aug 28

What is the Risk Free asset?

This question is probably only important when establishing a base-line return expectation before we accept various type of investment risk. I guess we all know that technically there is no such thing as a Risk Free Asset but generally speaking it is widely believed that Cash is the risk free asset. Whilst I’m prepared to …

Aug 15

RimSec August Research Update

I can’t believe its four weeks since my last post so obviously its been a terribly busy period. Anyway, something I have completed is a market/economic update and if anyone’s interested you can download it here. The update is probably consistent with what is being said everywhere…but either way… The mining investment boom is over …

Jul 12

RIMSec July Research Report

It has certainly been a while since I posted and, no, this blog is still active and hopefully I’ll be able to produce some good stuff sooner than later. Lots of analysis done, some interesting stuff too, just need the time to write it up. Anyway, I digress… I’ve just finished a short little Research …