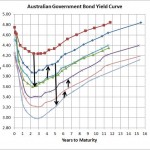

Source: RBA Its been a few weeks since I provided an update on the local government yield curve and consistent with the slight improvement in the sharemarket the Australian Government Bond Yield Curve has indicated a better outlook for the local economy. As the chart shows, since 6 January the yield curve has increased around …

Monthly Archive: January 2012

Jan 29

Fureyous.com.au …new domain name and a couple of teething problems

I’ve just set up www.fureyous.com.au as my new domain name so for any old michaeljfurey.com links they should automatically redirect to the new domain. Unfortunately, I may have lost a few subscribers so please resubscribe if you didn’t receive this post via email. Also, I may have lost my RSS feeds which were linked to …

Jan 25

Managing Market Risk using Variable Beta Funds

Lonsec have a reasonable investment strategy paper released today (subscription required) suggesting one of the best ways of managing equity market risk is to use variable beta managers. A variable beta manager is a manager who has the ability to significantly change their exposure to the market depending on their view. So if a variable …

Jan 19

Subscribe

I used to have an Email Subcription link on this site but I’ve only just realised that it didn’t work…I’ve fixed this by installing a Follow button that should appear on the bottom right of your screen. So if you want to be notified of my new posts please click on Follow and sign up! …

Jan 19

“Market Neutral Strategies as part of the Equity Allocation”…huh???

I read the following comment this morning in the Money Management daily enews…Market Neutral Funds Underrated: Zenith… There is demonstrable portfolio improvement to be had from allocating to market neutral strategies as part of the equity allocation… That says to me that if you want to improve your equities part of the portfolio then replace …

Jan 15

Bond ETFs on the ASX…now the game begins

With the ASX last week announcing that it is allowing bond ETFs to trade on the market, financial planners have the last basic building block in place to recommend portfolios that are completely listed covering all major asset classes. Previously listed portfolios were limited to equities (local and global of varying strategies) and commodities. With …

Jan 15

Keep art and collectables out of superannuation

In recent times I’ve seen quite a few articles about investing in art and other collectables in your superannuation fund (I guess in response to weak sharemarket returns), and its something that has always disturbed me as this is one gutsy investment strategy for the well informed let alone your typical investor. One of my …

Jan 14

Promoting the wrong Financial Planners

Sorry about this article but i have to express my disgust at an article I’ve just read on a former Storm Financial adviser in today’s Sydney Morning Herald…I reluctantly place the link here but I don’t want to give any more publicity to this adviser. Overall the article, by Stuart Washington, is quite fair and …

Jan 14

Buy-hold strategy may have had its day…I don’t think so

Page 31 of the Australian Financial Review (AFR) today has an article suggesting “that the traditional buy-hold approach to owning shares is dead”…full text, with subscription can be found here. The article’s stated reason for buy-hold is that “in the long run, markets always go up and will provide investors with a good return on …

Jan 11

Australian Goverment Bond Yield Curve…noisy improvement

Source: RBA The above chart shows the latest Australian Government Bond Yield curve which is around 5 to 2obps higher than it was a little over three weeks ago. On the scale of yield curve movement over the last few months its largely market noise and is therefore relatively meaningless…the market is still pricing in further …