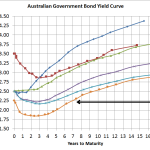

Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

Category Archive: Property

Oct 10

Impact of the rate cut on house prices

I am a little amazed at how many articles across the newspapers of Australia have suggested that residential house prices are going to go through the roof given the latest interest rate reduction from the RBA. The chart below shows that house prices have declined over the last couple of years or so, but somehow its …

Aug 11

Investment Perspectives

Its been a while since I put some of my broader investment thoughts in writing and I’ve just written almost 4000 words to satisfy that…so it also sort of makes up for my lack of posting. So below is a lot of what I have written and hopefully its readable for anyone interested…I actually haven’t …

Jun 05

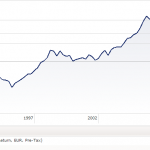

Spanish Property…and we complain about A-REITs!

Source: Morningstar The above is a long term chart of the S&P Spain Property Total Return index denominated in Euro. I was doing some other work looking for a particular index and came across this one…I thought it might be interesting and I guess it is…if you’re not Spanish. I don’t know how many property securities are …

May 10

A Few Investment-Related Budget Outcomes

As expected the Federal Budget focused on a surplus and to the government’s credit is looking to distribute some of their mining profits to the not so wealthy. Whilst the opposition is suggesting that some of the cash payments will be going straight to retailers instead of their intended purpose, that’s not necessarily a bad …

Apr 22

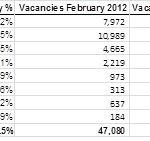

People appear to be choosing rent over property purchase

Following is a press release from SQM Research that was released last night. It pretty much says it all…residential vacancies relatively stable month on month and up a tiny bit year on year. Perth appears to be a rental concern with very few vacancies whilst Melbourne has the highest vacancy rate in Australia. Figures released …

Jun 12

Managing Inflation Risk…advisers have it wrong

Source: van Eyk Research The above poll was taken by van Eyk Research on their subscription website. In terms of the sample, it is large (848 responses) so may be statistically representative of van Eyk subscribers whom I can only assume is financial advisers, researchers, and maybe fund managers. As shown almost 1 in 2 …

May 26

Mortgage Arrears hits record high

I haven’t seen the numbers myself but just read this headline on the ABC24 so I assume its true. I guess the headline means only more downward pressure on residential housing prices as those under pressure are forced to sell, and sell at whatever they can. Certainly if the mortgagee doesn’t sell then ultimately the …

Dec 16

Global House Price Comparison

Found the above chart at The Big Picture . Unfortunately Australian Real House Prices are missing but I did a quick calculation using ABS data. From the start of 1997 to the start of 2008, inflation adjusted house prices in Australia increased from a base score of 100 to 212 which places Australia somewhere between …

Oct 03

Bond Yields – Rate Rise now a near Certainty

As mentioned around a month ago after the month of August a rate rise from the Reserve Bank appeared a long way away but September has certainly been a month for the risk takers. Aussie Dollar near record highs and the sharemarkets are up so of course that means government bonds are down. The above …