Its been a little while since I took a close look at some of the structured products that are out there…they’ve been a little unpopular due to their poor general track record over the GFC period, although in their defence they did what they promised, its just very few actually knew what they promised! Anyway, I digress.

A few years ago I posted a review of a particular structured product, criticising it for using a wrong formula…to this day it is the most viewed post on this blog due to many disgruntled investors searching for some answers…but I digress again…

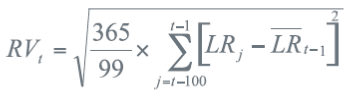

Once again…ANOTHER product with exactly the same mathematical error has emerged. A client (thanks G) sent me the product asking me to have a look and given it is another volatility-linked structured product…the first thing I look at is the volatility formula…which is…

Now I know this doesn’t mean a single thing to anyone reading this post so I’ll cut to the chase…this formula is wrong!!! RV is Realised volatility and is calculated by annualising the volatility of the last 100 trading days…annualising is done by multiplying the daily volatility by the square root of 365. However, because there are around 252 trading days in a year, the annualised volatility should multiply the daily volatility by the square root of 252…not 365 so the result is that the structured product’s volatility calculates to be more than 20% higher than it should….and guess what?!…because the participation rate of the underlying index just so happens to be the lesser of 1.5 or 0.15/RV, it means the higher the volatility the lower your participation rate of the index and therefore the lower the returns….so investors are misled with a lower than expected return due to a small print error that only people familiar with mathematical volatility formulae know.

Oh yeah…my other favourite part of this product (excuse my sarcasm) is the fact that the underlying index is a price index…so dividends are excluded (and they have to be as derivatives are always structured on price indices)…so investors who believe they are getting exposure to a full sharemarket index aren’t at all and this is a further drag on the expectedreturn of the product.

So investors are receiving the return that is linked to an incorrect volatility formula and a less than complete sharemarket index.

Instreet Masti Series 30 & 31… products that are bound to disappoint!