Many financial planners recommend their clients follow a particular Strategic Asset Allocation that may be based on the output of the combination of a risk profile as well as matching the client’s needs. For example, a popular strategic asset allocation for a “balanced” portfolio may be along the lines of… Australian Shares 35% Global Shares …

Category Archive: Investment Strategy

Feb 26

Jeremy Grantham’s latest Must-Read

Jeremy Grantham’s latest quarterly newsletter is on the GMO website and as usual it is an educational, pragmatic and brilliant read. There is so much to take away from this one. There are three parts to his ‘longest quarterly letter ever’… 1. Investment advice from your Uncle Polonius …which contains 10 absolute must read points. …

Feb 20

Excellent long term performance from bonds…but there’s a lot more to it

A look at the average returns of bonds over the last 30 years does not suggest that equity returns have really been worth the risk. Table 1 shows the returns on Australian Bonds (Aust Comm Bank All Series/All Maturities) versus the accumulated return of the Australian sharemarket (S&P/ASX 200 TR) and whilst equities have the better performance …

Jan 29

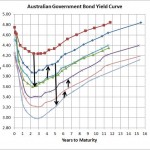

Australian Government Bond Yields…continue slight improvement

Source: RBA Its been a few weeks since I provided an update on the local government yield curve and consistent with the slight improvement in the sharemarket the Australian Government Bond Yield Curve has indicated a better outlook for the local economy. As the chart shows, since 6 January the yield curve has increased around …

Jan 25

Managing Market Risk using Variable Beta Funds

Lonsec have a reasonable investment strategy paper released today (subscription required) suggesting one of the best ways of managing equity market risk is to use variable beta managers. A variable beta manager is a manager who has the ability to significantly change their exposure to the market depending on their view. So if a variable …

Jan 19

“Market Neutral Strategies as part of the Equity Allocation”…huh???

I read the following comment this morning in the Money Management daily enews…Market Neutral Funds Underrated: Zenith… There is demonstrable portfolio improvement to be had from allocating to market neutral strategies as part of the equity allocation… That says to me that if you want to improve your equities part of the portfolio then replace …

Jan 15

Keep art and collectables out of superannuation

In recent times I’ve seen quite a few articles about investing in art and other collectables in your superannuation fund (I guess in response to weak sharemarket returns), and its something that has always disturbed me as this is one gutsy investment strategy for the well informed let alone your typical investor. One of my …

Jan 14

Buy-hold strategy may have had its day…I don’t think so

Page 31 of the Australian Financial Review (AFR) today has an article suggesting “that the traditional buy-hold approach to owning shares is dead”…full text, with subscription can be found here. The article’s stated reason for buy-hold is that “in the long run, markets always go up and will provide investors with a good return on …

Dec 25

Corporate Credit…maybe

Source: RBA Despite the above chart being a few weeks old, the above chart shows credit spreads have widened significantly over the past few months such that at the end of November, both A and BBB rated corporates have spreads in excess of 300bps. When you consider that the historic default risk is much much …

Dec 19

A few too many ‘China Hard Landing’ stories for my comfort

I’ve read a few too many times how Australia is well positioned because of its exporting links to China and how this should help us escape any serious economic issues flowing out of Europe. Obviously our markets haven’t quite agreed with that with bond yields dropping massively over recent months and our equity market continuing …