Source: www.incrediblecharts.com

Source: www.incrediblecharts.com

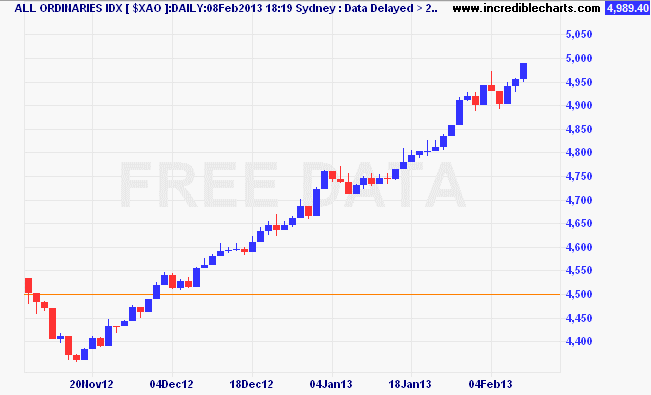

As the above chart shows the Australian Sharemarket has had a stellar run over the last 3 months. Not a hint of volatility just upwards she goes from around 4350 to just short of 5000…throw in a very small number of dividends and its a superb return.

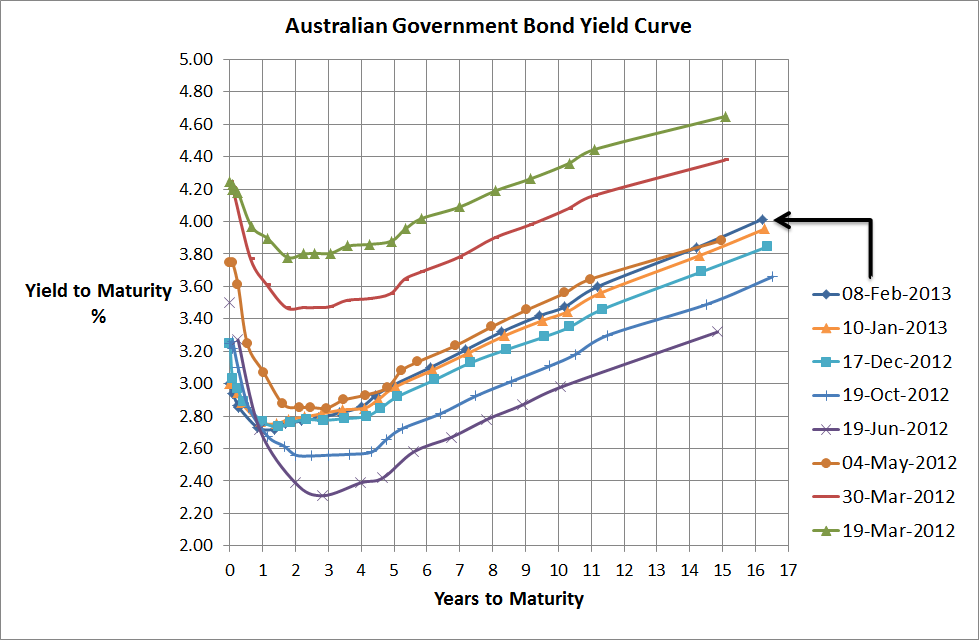

Newspaper talk has suggested that there is a switch out of bonds…the following yield curve does show that bond yields have increased, it pales in comparison to the run-up in the sharemarket. In fact, the yield curve is still trading in the same trading range it has followed since May 2012.

Source: RBA, Delta Research & Advisory

Source: RBA, Delta Research & Advisory

So will bonds eventually take a tumble (i.e. yields rise sharply)? It is certainly possible, but there are many factors keeping yields at low levels. Some of these include…

- Overseas demand for AAA rated debt…the Australian government is one of the few AAA rated sovereigns and contrary to what th opposition government says, Australian also has amongst the lowest debt levels in the world

- Australian government bonds are still yielding very high compared to other developed nations so assuming a relatively stable Australian dollar…this still makes our bonds attractive to overseas investors

- A deleveraging consumer…household savings rates in Australia continue to be over 10% of household income

- Baby boomers retiring and de-risking their portfolios…the baby boomers only started retiring at age 65 last year and moving their savings into safer fixed income products is a phenomenon that has many more years to play out

- tougher regulations on financial institutions resulting in their need to set aside greater levels of capital in safe bonds

These reasons are just off the top of my head and I’m sure there are several more I haven’t thought of. Suffice to say, the sharemarket’s run has been amazing and surprising in the face of declining expected earnings, fiscal cliff , and a bearish RBA (albeit Europe has calmed and QE has helped); bonds have held firm and are unlikely to collapse any time soon (which is not to say they won’t go down as they might), so where to invest your money? I’m afraid I’m always going to have to go back to two old investment rules and risk being ultra-boring…diversify and invest for the long term…market timing is too tough a gig.