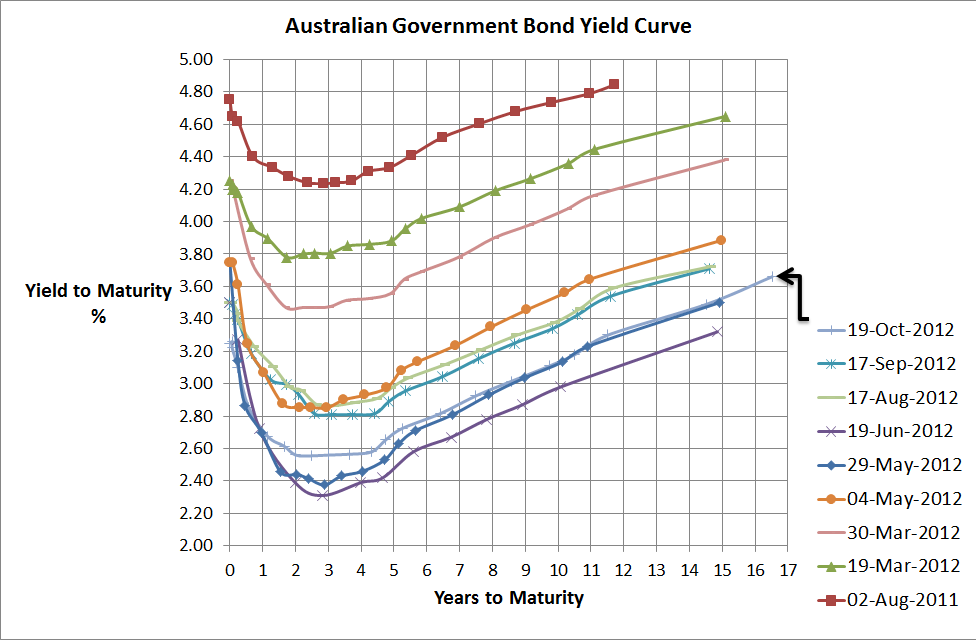

Source: RBA & Delta Research & Advisory

I can’t believe how time is flying and it is more than a month since I posted my last bond yield curve. The Mid Year Economic & Fiscal Outlook released today has provided numbers supporting a further slowdown in government revenue and this economic weakness has certainly been reflected in reducing bond yields over the last month as well as since the Budget in May (where its down around 25bps). We all know the Reserve Bank reduced its cash rates by 25bps a few weeks ago and over the last month the yield curve is also down around 20-25bps. Interestingly we have a new data point (or 16.5 year government bond) which has been trading for a little over a week so if you’re gong to raise money at these low rates why not raise the capital across the longest period possible.

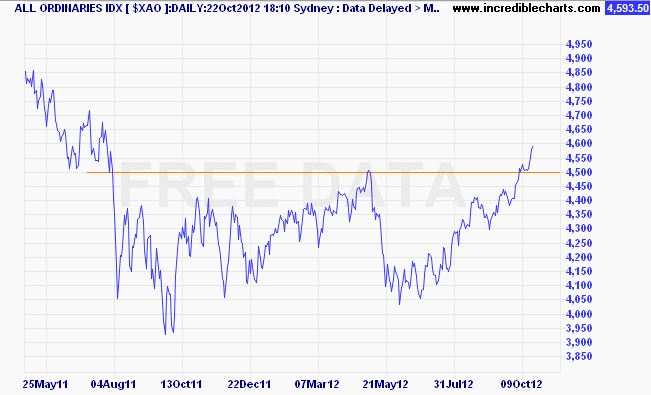

Whilst the bond market is showing signs of economic weakness the sharemarket has finally broken above the 4500 barrier that has proved so difficult over the last year or so (see below chart). The feeling is that there isn’t too much that can shock anymore so sharemarkets have become quite relaxed about the worsening European data, although perhaps the, by and large, better US economic data has provided some of the confidence that global economic recovery may move faster than previously expected…who knows.

What I find most interesting in the behaviour of markets in recent weeks is that both bond markets and sharemarkets have increased in price and that is completely different to the last 5 years where they moved in opposite directions. I don’t really know why that’s the case and its not necessarily wrong…perhaps both markets were underpriced or they are being driven by different fundamentals…at the end of the day week to week or month to month movement contains a lot of noise and whilst bonds yields are near record lows, which is not a good sign for our economy, its pretty safe to say that sharemarkets are still largely languishing compare to 5 years ago when the All Ords was over 6800.

Source: Incredible Charts

Moving along, the outlook is still cloudy…the US is recovering but very slowly and unemployment is still uncomfortably high; the European situation is years away from resolution and the survival of the Euro is still not guaranteed (but markets have certainly calmed over the past few months); but the bigger news is the slowing Australian economy thanks to the resources boom not booming as much as we’d like and the rest of the economy continuing to splutter along. Despite that the government is still expecting unemployment to be fairly low and economic growth has only been revised down 25bps in 2013.

For me, the best bang for your buck continues to be term deposits that continue to pay 200bps to 250bps above government bonds but aside from that its difficult to go beyond a diversified portfolio across all major asset classes.