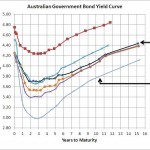

Source: RBA I know the above chart is a couple of days old but there’s not much change since last Thursday. At its simplest what it shows is that the bond market is still expecting the Reserve Bank to decrease interest rates some time during the year…with 1 year bond yields at less than 4%, …

Tag Archive: Interest Rates

Feb 20

Excellent long term performance from bonds…but there’s a lot more to it

A look at the average returns of bonds over the last 30 years does not suggest that equity returns have really been worth the risk. Table 1 shows the returns on Australian Bonds (Aust Comm Bank All Series/All Maturities) versus the accumulated return of the Australian sharemarket (S&P/ASX 200 TR) and whilst equities have the better performance …

Feb 09

Australian Government Bond Yields…still creeping up

When I saw the headline in the Market section of today’s Australian Financial Review I thought bond yields must have gone through the roof but the above chart shows that there ‘s only a relatively small increase compared to a couple of weeks ago. Markets had obviously priced in a rate decrease from the Reserve …

Jan 29

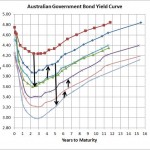

Australian Government Bond Yields…continue slight improvement

Source: RBA Its been a few weeks since I provided an update on the local government yield curve and consistent with the slight improvement in the sharemarket the Australian Government Bond Yield Curve has indicated a better outlook for the local economy. As the chart shows, since 6 January the yield curve has increased around …

Jan 11

Australian Goverment Bond Yield Curve…noisy improvement

Source: RBA The above chart shows the latest Australian Government Bond Yield curve which is around 5 to 2obps higher than it was a little over three weeks ago. On the scale of yield curve movement over the last few months its largely market noise and is therefore relatively meaningless…the market is still pricing in further …

Jan 10

The change in outlook for the 2011 Australian Economy in one picture

Source: RBA The above chart shows pretty much what happened to the outlook for the Austrlaian economy and why bonds were the best investment for the year. It shows the longer terms yields (3 years and above) dropping by up to 200bps thus providing very large capital gains for bond investors who had the courage …

Dec 07

Australian Government Bond Yield Curve…no change in 2 weeks

Source: RBA As the above chart shows the yield curve dropped significantly from the start of August through to towards the end of November and at the end of yesterday after the RBA dropped the cash rate another 25bps to 4.25%, the yield curve is basically the same as it was two weeks ago. Whilst …

Nov 24

Australian Government Bond Yields…seriously low

Source: RBA Just when you think the yield curve can’t get any lower, the last 8 days have taken another 10 to 15bps off. Sharemarkets have obviously dropped on the Euro-debacle and this yield curve demonstrates not only significant interest rate reductions in the months to come but a significantly slowing Australian eonomy thanks to …

Nov 16

Australian Government Bonds…even lower!

Source: RBA Since August the Australian Government Bond yield curve has dropped massively indicating the lower expectation of interest rates and the deteriorating outlook for our economy. I’ve voiced my increasingly bearish view of the Eurozone situation so I won’t go on any further about so I’ll mention the new addition to my yield curve…the …