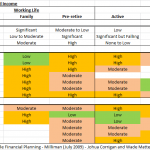

Found the above heat map in an interesting article on life cycle financial planning on Milliman’s website … click here for the article. I think the heat map speaks for itself…(although apologies for the spelling errors..my bad)…and clearly points out the risks that generally need to be addressed at various points in time. As the …

Tag Archive: Financial Planning

May 20

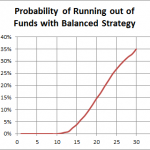

Being a millionaire may not be enough for a comfortable retirement

Source: Delta Research & Advisory Pty Ltd The above chart shows the probability of running out of funds in retirement for someone who retires with $1,000,000 in today’s dollar and draws $55,080 each year (ASFA Retirement Standard for a comfortable retirement for a couple), growing at 3% inflation. It is assumed the funds are invested …

May 07

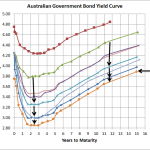

Australian Government Bond Yields…supports the dumb budget

Source: RBA As the above chart shows, the yield curve has dropped 70 to 90bps for all terms since March 19. With a 3 year bond yield just above 2.80%, which is close to where it was during the worst of the GFC, its pretty obvious markets aren’t too confident in the strength of our …

Apr 16

Retirement Income Portfolios – poorly understood

One of the debates in the financial services media has been around the investment strategy of superannuation funds and whether they are holding too many equities. In the camp of too many equities is former Head of Treasury, Ken Henry, nd former Chairman of the Future Fund, David Murray; and opposing views have typically been …

Mar 27

Does our Super have too much in equities?

Over the last couple of weeks I’ve been asked to comment on the asset allocations of default super funds. There’s certainly been a very interesting debate through the print media which was probably started by David Murray, Chairman of the Future Fund, last year when he stated that Austrlaian Super Funds were too heavily invested …

Mar 10

SPIVA…Australian Small Cap managers demonstrate skill

The SPIVA report was released a few days ago and as I’ve mentioend before it is my favourite assessment of the success of fund managers because it takes into consideration survivorship bias…in other words, if you want to know who are the best fund managers over the last year, then you start with all fund …

Mar 04

Portfolio vs Asset Allocation…potential pitfalls

Many financial planners recommend their clients follow a particular Strategic Asset Allocation that may be based on the output of the combination of a risk profile as well as matching the client’s needs. For example, a popular strategic asset allocation for a “balanced” portfolio may be along the lines of… Australian Shares 35% Global Shares …

Feb 20

Excellent long term performance from bonds…but there’s a lot more to it

A look at the average returns of bonds over the last 30 years does not suggest that equity returns have really been worth the risk. Table 1 shows the returns on Australian Bonds (Aust Comm Bank All Series/All Maturities) versus the accumulated return of the Australian sharemarket (S&P/ASX 200 TR) and whilst equities have the better performance …

Jan 15

Bond ETFs on the ASX…now the game begins

With the ASX last week announcing that it is allowing bond ETFs to trade on the market, financial planners have the last basic building block in place to recommend portfolios that are completely listed covering all major asset classes. Previously listed portfolios were limited to equities (local and global of varying strategies) and commodities. With …

Jan 14

Promoting the wrong Financial Planners

Sorry about this article but i have to express my disgust at an article I’ve just read on a former Storm Financial adviser in today’s Sydney Morning Herald…I reluctantly place the link here but I don’t want to give any more publicity to this adviser. Overall the article, by Stuart Washington, is quite fair and …