The biggest market in the world, often represented by the S&P 500 index, crashed pretty quickly from 24 February reaching its bottom on 23 March. This fall, in US Dollars, was around 34%. Since then, it has bounced back by around 25% after almost 5 weeks … not a bad turnaround, but obviously not back …

Category Archive: US Economy

Aug 02

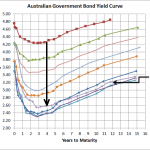

Australian Government Bond Yield Curve…slight increase but risks remain

Source:RBA The above chart shows that over the last few weeks there has been an increase of around 10-25bps across the yield curve which is also in line with the marginally stronger equity markets. As I’ve stated numerous times before, the European situation is what is currently driving most major market moves and the partial …

Apr 08

Bad economic data is underway

Source: www.zerohedge.com Earlier in the week Zero Hedge showed the above chart and unfortunately there maybe something to it as it appears the outlook may be deteriorating. Whilst policymakers haven’t started to dither in obvious ways at the moment, with the Spanish government announcing increased austerity measures which will only make their economy worse, there …

Apr 02

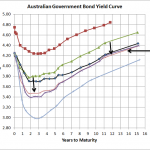

Australian Government Bond Yields…a rate cut suggestion?

Source: RBA In less than two weeks the yield curve managed to drop around 15bps back to levels similar to those of late January. This is despite slightly stronger equity markets, the ASX200 made it through the 4,300 barrier for the first time in many months, and not that much in the way of really bad news…I …

Mar 20

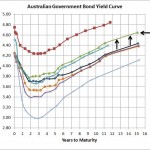

Australian Government Bond Yields…approaching normal

Well…not normal yet. The shorter part of the curve suggests the market is expecting another two 25bps cuts by the RBA but with the Euro sovereign crisis well and truly looking much better its highly unlikely there’ll be any cuts soon. Whilst there’s plenty of evidence that shows the Euro sovereign crisis has improved, nothing …

Feb 09

Australian Government Bond Yields…still creeping up

When I saw the headline in the Market section of today’s Australian Financial Review I thought bond yields must have gone through the roof but the above chart shows that there ‘s only a relatively small increase compared to a couple of weeks ago. Markets had obviously priced in a rate decrease from the Reserve …

Feb 07

A little bit of Bond misinformation

I was just reading the latest riveting story on bonds in this month’s Asset magazine and I feel compelled to share an example of misinformation that tends to annoy me a little (I know its probably a little pathetic but anyway)…John O’Brien, van Eyk – Head of Research, apparently said that many of the great …

Sep 22

Europe equity markets getting smashed…

…and US futures not looking much better. The Euro Stoxx 50 is down 4.4% at the time of writing; UK, German, French, and Spanish equity markets are all down more than 4.3%. The S&P500 futures are down around 1.5% and Australia’s SPI200 is also down around 1%. Plenty of downside risk yet whilst politicians kick …

Sep 21

Tonight should be a turning point…either way

With the Federal Open Mark Committee (FOMC) currently meeting, many pundits are expecting a very very big package to be announced by Ben Bernanke tomorrow. If its not what the market expects, then I imagine there’ll be more equity market pain but if it is big, then I’m confident we’ll see a strong market (so …

Sep 10

A few thoughts on investment strategy for today

With the US heading towards recession and the Euro Sovereign Crisis getting ugly again where to invest one’s funds has never been tougher. Australian bonds yields are around 4%, meaning they are on PE ratio of 25 which compared to local and global shares, which are currently on forward PEs of around 10, are very …