Source: www.zerohedge.com

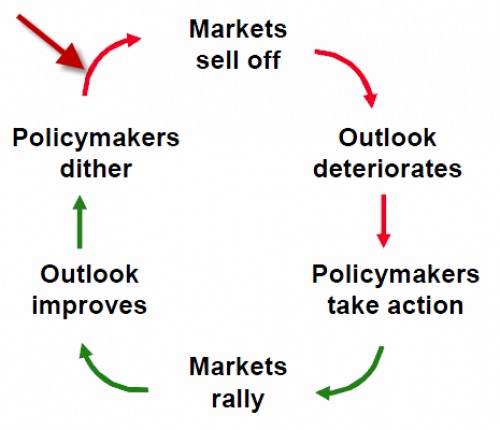

Earlier in the week Zero Hedge showed the above chart and unfortunately there maybe something to it as it appears the outlook may be deteriorating. Whilst policymakers haven’t started to dither in obvious ways at the moment, with the Spanish government announcing increased austerity measures which will only make their economy worse, there are market signs that the European situation is starting to worsen….namely Spanish and Italian bond yields have started an upward march towards uncomfortable bond affordability. (see below charts)

Source: Bloomberg

The last day of the trading week also saw the US post some pretty dismal employment figures…only 120,000 new jobs were gained in March after a strong couple of months to start the year. There were expectations of 200,000 jobs but given 125,000 new jobs are required just to keep up with population growth 120,000 is not a good number. Whilst some of the company data in the US is reasonably good, its obvious they’re still not confident enough to hire and the unemployment problem continues to leave US in the doldrums for many

Anyway, none of this adds up to strong macro signals for the risk-on trade so we can probably expect some increased market volatility this week and beyond. The S&P/ASX200 VIX shown in the chart below is at relatively low levels and if this was an easily investible index (and its not), this is my current pick as an asset about to rise.

Source: www.asx.com.au