Source: RBA, Delta Research & Advisory The above chart shows that the Australian Government Bond Yield Curve really hasn’t moved that much in the last 3 months…around an increase of 20bps which is not much at all when you consider all the talk about switching from equities to bonds. The reality is that there has …

Category Archive: Europe

Jan 11

Australian Government Bond Yield Curve…still barely moving but…

Source: RBA, Delta Research & Advisory I had no idea that I’ve only posted twice since November, so here I am again with my favourite chart, the Australian Government Bond Yield. As the above chart shows, over the past couple of months, yields have increased on average around 20bps across the longer end of the …

Sep 18

Australian Government Bond Yield Curve…no change???

Source: RBA, Delta Research & Advisory Bizaarely as it seems but the above chart shows that over the last month the Australian Government Bond Yield curve has barely budged. There’s really no more than 5 to 10 bps difference across all terms and when you consider the various big announcements, economic results from here, overseas …

Aug 20

Australian Government Bond Yield Curve…continued improvement

Source: RBA With equity markets improving over the past few weeks, so too have Australian Government Bond yields increased. 10 Year yields were below 3% a couple of months ago and now they are hovering near 3.5%. For Australian bond fund owners that should be a capital loss of close to 2% since mid-June. Nevetheless …

Aug 11

Investment Perspectives

Its been a while since I put some of my broader investment thoughts in writing and I’ve just written almost 4000 words to satisfy that…so it also sort of makes up for my lack of posting. So below is a lot of what I have written and hopefully its readable for anyone interested…I actually haven’t …

Aug 02

Australian Government Bond Yield Curve…slight increase but risks remain

Source:RBA The above chart shows that over the last few weeks there has been an increase of around 10-25bps across the yield curve which is also in line with the marginally stronger equity markets. As I’ve stated numerous times before, the European situation is what is currently driving most major market moves and the partial …

Jun 19

Australian Government Bond Yields…a little lower still this month

Source: Reserve Bank, Bloomberg I’ve placed this chart on my website more as a reference for an upcoming presentation I’m giving than for any real message it conveys. Basically not too much change…yields are slightly lower than they were at the end of May but they increased a little from a couple of weeks ago …

Jun 18

So much for the Greek election…Spanish bond yields getting ugly

Source: Bloomberg Spanish bond yields are a far greater concern than Greece…Greece’s exit from the Euro unfortunately is inevitable and the Pro-Austerity victory in the election will just create a delay for, hopefully, an orderly exit from the Euro. With Spanish 10 year bond yields now above 7%, which are completely unsustainable levels, another bailout will undoubtedly …

Jun 12

So much for the Spanish bailout…yields are heading higher

[table id=1 /] So much for the Spanish bailout… Their 10 year bond yields are heading back up towards 7% and Italian 10year bonds are over 6% and trending up. The half life of any temporary bailout appears to be getting shorter and shorter…not that European equity markets care too much…they’re up a little bit …

Jun 05

Spanish Property…and we complain about A-REITs!

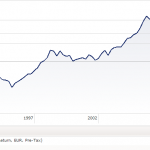

Source: Morningstar The above is a long term chart of the S&P Spain Property Total Return index denominated in Euro. I was doing some other work looking for a particular index and came across this one…I thought it might be interesting and I guess it is…if you’re not Spanish. I don’t know how many property securities are …