Author's details

Date registered: January 28, 2012

Latest posts

- Random Thoughts on Cryptocurrencies at a Random time of the year — December 31, 2022

- Investment Philosophy … a short primer — June 6, 2022

- A Few ESG Investment Thoughts — June 28, 2021

- Approaching the Zero bound — May 22, 2020

- Worry about Valuations??? … yeah, a bit … — April 24, 2020

Most commented posts

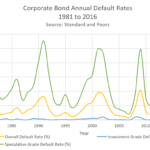

- The disappearing credit spread…US now at pre-GFC levels — 6 comments

- ASX200 to go through 5000!!! — 4 comments

- A Must Read on “The Economic State of Australia” — 4 comments

- Tonight should be a turning point…either way — 3 comments

- Asset Allocation that considers Asset Weighted Returns — 3 comments