I’m always fascinated by the various changes in financial market behaviour and this economic lockdown has created some new behaviours in the cash or money markets not seen before (or that I’m aware of). The chart below shows the performance of 3 cash benchmarks: RBA Cash Rate Target … currently 25bps (Green) RBA Cash Overnight …

Category Archive: Yield Curve

Mar 19

Most markets are mostly efficient most of the time … maybe not so much now

Its clearly been a long time since I updated this blog and perhaps this current crisis makes most sense to make a comeback; particularly given I started this blog not long after the worst of the GFC (Jan 2009 to be precise). Anyway, the current crisis has clearly required a global response to slow down …

Jun 20

Market Inflation Expectations…lower than RBA

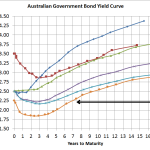

The above chart shows the yields for Australian Government Bonds, both nominal bonds and indexed bonds, as at the end of last week (although you can adjust the pricing date to any trading day of 2016). A simple way to determine the market’s inflation expectations over different timeframes is to simply subtract the difference. If …

Feb 21

A few simple thoughts on a few not so simple markets

Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

May 16

Australian Bond Yield Curve…small budget led drop

Source: RBA, Delta Research & Advisory At the e shorter end of the yield curve there hasn’t been a great deal of change. This is completely expected whilst the RBA has signaled its intention to maintain its cash rate at 2.5% for some time and, whilst not easy to tell, this yield curve suggests it …

Jan 13

Longer duration looking less risky…relatively speaking

Source: RBA & Delta Research & Advisory Its definitely been a long time since I posted anything and hopefully this post will at least be a little interesting…I haven’t read a great deal of anything financial over the past few weeks so I apologise if this is old news….but I digress!! Now, the above chart …

Oct 21

Australian Government Bond Yields…little change in a month but…

Source: RBA & Delta Research & Advisory The above chart shows very little change in Australian Government Bond yields over the last month which given what’s been happening in the US seems a little surprising. We’ve had massive fund managers losing confidence in the US Government and selling out of Treasury bonds and there …

Sep 23

RimSec September Research Report

This was written last week so is only a couple of days old so here is the RimSec monthly research report for those who are interested. Click here to download. There is the usual commentary on interest rates, the economy, and market expectations. The final article is a small piece on what is happening and …

Aug 15

RimSec August Research Update

I can’t believe its four weeks since my last post so obviously its been a terribly busy period. Anyway, something I have completed is a market/economic update and if anyone’s interested you can download it here. The update is probably consistent with what is being said everywhere…but either way… The mining investment boom is over …

Jul 12

A fascinating correlation…and why the Aussie dollar may have declined

Source: Delta Research & Advisory, RBA Firstly the red line represents the US dollar/Aussie Dollar (RH Axis), so as the chart shows the US Dollar has strengthened since around the middle of April (so you can ignore the AUD label). The other line is the difference in yield (or spread) between the Australian 10 …