Source: RBA With equity markets improving over the past few weeks, so too have Australian Government Bond yields increased. 10 Year yields were below 3% a couple of months ago and now they are hovering near 3.5%. For Australian bond fund owners that should be a capital loss of close to 2% since mid-June. Nevetheless …

Category Archive: Sovereign Crisis

Aug 11

Investment Perspectives

Its been a while since I put some of my broader investment thoughts in writing and I’ve just written almost 4000 words to satisfy that…so it also sort of makes up for my lack of posting. So below is a lot of what I have written and hopefully its readable for anyone interested…I actually haven’t …

Aug 02

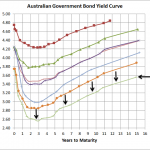

Australian Government Bond Yield Curve…slight increase but risks remain

Source:RBA The above chart shows that over the last few weeks there has been an increase of around 10-25bps across the yield curve which is also in line with the marginally stronger equity markets. As I’ve stated numerous times before, the European situation is what is currently driving most major market moves and the partial …

Jun 19

Australian Government Bond Yields…a little lower still this month

Source: Reserve Bank, Bloomberg I’ve placed this chart on my website more as a reference for an upcoming presentation I’m giving than for any real message it conveys. Basically not too much change…yields are slightly lower than they were at the end of May but they increased a little from a couple of weeks ago …

Jun 18

So much for the Greek election…Spanish bond yields getting ugly

Source: Bloomberg Spanish bond yields are a far greater concern than Greece…Greece’s exit from the Euro unfortunately is inevitable and the Pro-Austerity victory in the election will just create a delay for, hopefully, an orderly exit from the Euro. With Spanish 10 year bond yields now above 7%, which are completely unsustainable levels, another bailout will undoubtedly …

Jun 12

So much for the Spanish bailout…yields are heading higher

[table id=1 /] So much for the Spanish bailout… Their 10 year bond yields are heading back up towards 7% and Italian 10year bonds are over 6% and trending up. The half life of any temporary bailout appears to be getting shorter and shorter…not that European equity markets care too much…they’re up a little bit …

May 30

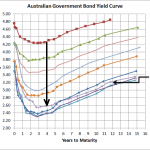

Australian Government Bond Yields…setting new records

Source: RBA I know I’ve written more posts on the Australian Government Bond Yield than ever but with the yield curve hitting record lows its pretty hard to ignore. The above chart shows where the yields finished yesterday and today they’re lower again. The European situation is definitely the main driver as funds move to …

May 18

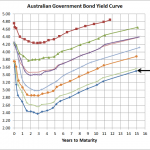

Australian Government Bond Yields…continue record lows

Source: RBA In less than 2 weeks the Australian Government Bond yield curve has dropped another 20bps plus and since August last year, the yield curve has dropped around 160bps on average…which means for bond fund owners double digit returns over the previous 12 months continue. Obviously the main reason for this drop in yield …

Apr 19

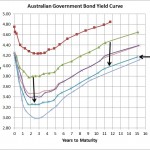

Australian Government Bond Yields…heading south again

Source: RBA The above chart shows that bond yields shows that after bond yields reached a high around 1 month ago they have declined across all terms by around 50bps. That means that most of the traditional bond funds would have produced capital gains of around 2% over that last month (because the duration od …

Apr 08

Bad economic data is underway

Source: www.zerohedge.com Earlier in the week Zero Hedge showed the above chart and unfortunately there maybe something to it as it appears the outlook may be deteriorating. Whilst policymakers haven’t started to dither in obvious ways at the moment, with the Spanish government announcing increased austerity measures which will only make their economy worse, there …