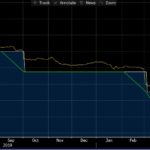

I’m always fascinated by the various changes in financial market behaviour and this economic lockdown has created some new behaviours in the cash or money markets not seen before (or that I’m aware of). The chart below shows the performance of 3 cash benchmarks: RBA Cash Rate Target … currently 25bps (Green) RBA Cash Overnight …

Category Archive: Interest Rates

Mar 19

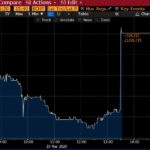

RBA announces 3yr target of 0.25% and drops cash to 0.25% … & a very strange yield curve

Reaction to 3 year bond price in the first chart below … that’s still a 0.5% yield to maturity. So the RBA are saying they want 0.25% yield to maturity which is a high bond price but only little bit of interest in the first 5 minutes or so off the bat. Source: Bloomberg A …

Mar 19

Most markets are mostly efficient most of the time … maybe not so much now

Its clearly been a long time since I updated this blog and perhaps this current crisis makes most sense to make a comeback; particularly given I started this blog not long after the worst of the GFC (Jan 2009 to be precise). Anyway, the current crisis has clearly required a global response to slow down …

Jun 20

Market Inflation Expectations…lower than RBA

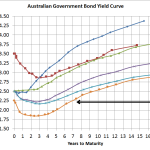

The above chart shows the yields for Australian Government Bonds, both nominal bonds and indexed bonds, as at the end of last week (although you can adjust the pricing date to any trading day of 2016). A simple way to determine the market’s inflation expectations over different timeframes is to simply subtract the difference. If …

Feb 07

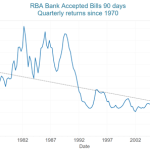

Some Simplisitic Australian Market Analysis … setting a forecast baseline and a few trend-lines

Like all economies, the Australian economy is always facing significant challenges. Since 1970 there has been the 1973 oil crisis and double digit inflation of the 1970s, the 1980-81 recession, further high inflation of the 1980s, crash of 1987, the recession we had to have in 1991, Asian crisis of 1998, global tech crash from …

Feb 21

A few simple thoughts on a few not so simple markets

Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

May 16

Australian Bond Yield Curve…small budget led drop

Source: RBA, Delta Research & Advisory At the e shorter end of the yield curve there hasn’t been a great deal of change. This is completely expected whilst the RBA has signaled its intention to maintain its cash rate at 2.5% for some time and, whilst not easy to tell, this yield curve suggests it …

Jan 13

Longer duration looking less risky…relatively speaking

Source: RBA & Delta Research & Advisory Its definitely been a long time since I posted anything and hopefully this post will at least be a little interesting…I haven’t read a great deal of anything financial over the past few weeks so I apologise if this is old news….but I digress!! Now, the above chart …