Over the years having worked in consulting and research I have been sent countless portfolios for opinion. Virtually all portfolios have followed a pre-defined asset allocation aligned to a specific risk profile but occasionally that is where the alignment ends. This is because the investments selected bear little to no relationship with their desired characteristics …

Tag Archive: portfolio construction

Apr 27

From Asset Allocation to Risk Allocation

Background After capital market forecasts and assessing investor objectives, the current method for portfolio construction starts with the asset allocation decision followed by investment selection. In the Australian financial planning industry, it widely accepted that the asset allocation decision is responsible for most of the portfolio performance variability, and it is, rightly or wrongly, regarded …

Mar 14

Diversification … clearing up what it is and what it isn’t

Diversification is one of the central tenets of investment management and fundamental beliefs across the global financial planning industry. Its validity was set in stone by Harry Markowitz in his PhD dissertation and 1952 Journal of Finance article, Portfolio Selection, which demonstrated the effects of combining uncorrelated assets … i.e. improvement in the portfolio’s return …

Jan 14

Designing the rules of the game … Investment Policy Statement (IPS)

The following article was published by Professional planner Magazine a couple of months ago and whilst can be found on their website by clicking here … the original article follows. Background One of the biggest trends in the financial planning today is the shift towards managed accounts. This is primarily an exercise in increasing efficiencies …

Aug 29

Beware the Benchmark Hugger … it might be you?

Background For quite a few years now, many commentators and researchers have criticized active strategies that charge active fees to receive benchmark-like returns. If a portfolio looks a lot like the benchmark it is trying to outperform, it doesn’t mean there won’t be outperformance, but after taking fees into consideration it is much more difficult. …

Aug 17

Look for the Signal amongst the Noise

Background When disappointing performance occurs, alarm bells will typically ring in the minds of investors, advisers, asset consultants and perhaps the managers themselves. Investing has only ever been a long game but thanks to the internet, the 24-hour news cycle, social media, etc. etc., it appears that success is expected to occur quickly and this …

May 30

The influence of equities on multi-asset strategies…both less and more than you think

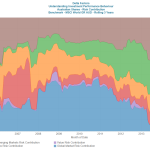

Background Over recent years many commentators and experts have spoken of the significant risks superannuation funds are carrying with respect exposure to Australian equities. Most notable were comments a few years ago from David Murray, former Chairman of the Future Fund, and Ken Henry, former Federal Treasurer, who both said they had concerns that Australian superannuation funds …

Mar 30

Australian Equities Market from a Global Equities Perspective…quant- style

It’s well known that the Australian equity market is only around 2% of Global equity markets. When we have allocations that overweight the Australian equities asset class compared to the Global equities asset class in our portfolios, it is typically justified due to the benefits of franking credits, higher dividends, and perhaps familiarity. The primary risks associated with …

Nov 07

The importance of asset allocation in Australia…BHB revisited

We’ve all seen various developments in product design from hedge funds to long/short to real return approaches, and then there’s the increased focus on tactical and dynamic asset allocation. You would expect all of this to lead to different drivers of portfolio risk…i.e. away from traditional asset class drivers to market timing, investment selection, and …

Sep 20

A widely accepted portfolio construction flaw

The typical approach to portfolio construction in the world of financial planning is a 2-step process (of course, this is after the desired risk and return characteristics are settled). The first step is setting asset allocation and the second is investment selection where most of the industry chooses to select from a variety of managed fund strategies. …