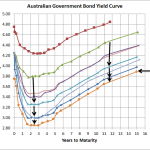

Source: RBA I know I’ve written more posts on the Australian Government Bond Yield than ever but with the yield curve hitting record lows its pretty hard to ignore. The above chart shows where the yields finished yesterday and today they’re lower again. The European situation is definitely the main driver as funds move to …

Monthly Archive: May 2012

May 25

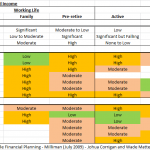

A Heat Map of risks and income for Life Cycle Financial Planning

Found the above heat map in an interesting article on life cycle financial planning on Milliman’s website … click here for the article. I think the heat map speaks for itself…(although apologies for the spelling errors..my bad)…and clearly points out the risks that generally need to be addressed at various points in time. As the …

May 20

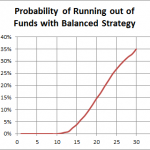

Being a millionaire may not be enough for a comfortable retirement

Source: Delta Research & Advisory Pty Ltd The above chart shows the probability of running out of funds in retirement for someone who retires with $1,000,000 in today’s dollar and draws $55,080 each year (ASFA Retirement Standard for a comfortable retirement for a couple), growing at 3% inflation. It is assumed the funds are invested …

May 18

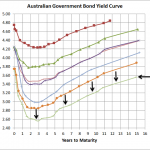

Australian Government Bond Yields…continue record lows

Source: RBA In less than 2 weeks the Australian Government Bond yield curve has dropped another 20bps plus and since August last year, the yield curve has dropped around 160bps on average…which means for bond fund owners double digit returns over the previous 12 months continue. Obviously the main reason for this drop in yield …

May 12

A Slideshow on the European Crisis

Paul Krugman, Nobel Prize-winning Princeton Economics Professor, has placed an upcoming presentation on the European Crisis on his website…please click here. It is such a simple story as to how badly Europe is going, why it erred, and why to continues to err. Some of the fascinating points in his slideshow include… British GDP has performed worse …

May 10

A Few Investment-Related Budget Outcomes

As expected the Federal Budget focused on a surplus and to the government’s credit is looking to distribute some of their mining profits to the not so wealthy. Whilst the opposition is suggesting that some of the cash payments will be going straight to retailers instead of their intended purpose, that’s not necessarily a bad …

May 08

World’s 10 Strongest Banks (by Nation)

I thought this list would have contained at least a couple of Australian banks given their high credit ratings, profitability, and belonging to one of the stronger developed economies of the world. Anyway, the top 10 strongest banks can be found by clicking on the following link… Bloomberg’s List of World’s Strongest Banks. or World’s …

May 07

Australian Government Bond Yields…supports the dumb budget

Source: RBA As the above chart shows, the yield curve has dropped 70 to 90bps for all terms since March 19. With a 3 year bond yield just above 2.80%, which is close to where it was during the worst of the GFC, its pretty obvious markets aren’t too confident in the strength of our …

May 07

Australia’s Dumb Budget

I don’t have a great deal to say other than I thought I’d take this opportunity to point out, again, that with Australia’s multi-speed economy there is absolutely no logic in having a budget surplus. The budget surplus has become a political football that is not based on logic but is based on some ridiculous …