Background Over recent years many commentators and experts have spoken of the significant risks superannuation funds are carrying with respect exposure to Australian equities. Most notable were comments a few years ago from David Murray, former Chairman of the Future Fund, and Ken Henry, former Federal Treasurer, who both said they had concerns that Australian superannuation funds …

Category Archive: Superannuation

Nov 08

Merton’s Retirement Income Views…correct but its not a product solution…its an advice solution!!!

Nobel laureate economist Robert Merton says David Murray’s Financial System Inquiry must fundamentally shift how Australia thinks about superannuation. He says the desire to maximise lump-sum balances at retirement is excessively risky; the focus should be on ensuring retirement income is enough to meet a desired standing of living. Source: AFR – 6 Nov 2014 …

May 05

Revisiting Asset Weighted Returns and the Lifecycle Fund

Given the start of MySuper this year, superannuation trustees have released numerous lifecycle funds to satisfy this new legislation. Whilst lifecycle funds have been popular among superannuation trustees, the investment and adviser community haven’t been so complimentary. Either way, lifecycle funds definitely have a place in the investment landscape and they provide an approach to …

Nov 17

Life Expectancy Myths and Facts…and should we increase the pension age

This week I read a couple of articles on US Life Expectancy trends that got me curious about the situation in Australia…the articles were written by Paul Krugman and Aaron Carroll and basically implied that life expectancies aren’t increasing as much as everyone thinks and if you think that the age pension age should be …

May 20

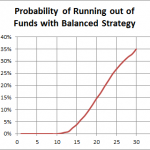

Being a millionaire may not be enough for a comfortable retirement

Source: Delta Research & Advisory Pty Ltd The above chart shows the probability of running out of funds in retirement for someone who retires with $1,000,000 in today’s dollar and draws $55,080 each year (ASFA Retirement Standard for a comfortable retirement for a couple), growing at 3% inflation. It is assumed the funds are invested …

Apr 16

Retirement Income Portfolios – poorly understood

One of the debates in the financial services media has been around the investment strategy of superannuation funds and whether they are holding too many equities. In the camp of too many equities is former Head of Treasury, Ken Henry, nd former Chairman of the Future Fund, David Murray; and opposing views have typically been …

Mar 27

Does our Super have too much in equities?

Over the last couple of weeks I’ve been asked to comment on the asset allocations of default super funds. There’s certainly been a very interesting debate through the print media which was probably started by David Murray, Chairman of the Future Fund, last year when he stated that Austrlaian Super Funds were too heavily invested …

Feb 20

Excellent long term performance from bonds…but there’s a lot more to it

A look at the average returns of bonds over the last 30 years does not suggest that equity returns have really been worth the risk. Table 1 shows the returns on Australian Bonds (Aust Comm Bank All Series/All Maturities) versus the accumulated return of the Australian sharemarket (S&P/ASX 200 TR) and whilst equities have the better performance …

Jan 15

Keep art and collectables out of superannuation

In recent times I’ve seen quite a few articles about investing in art and other collectables in your superannuation fund (I guess in response to weak sharemarket returns), and its something that has always disturbed me as this is one gutsy investment strategy for the well informed let alone your typical investor. One of my …

Oct 10

Asset Allocation that considers Asset Weighted Returns

My earlier posts on asset-weighted returns got me thinking about how to apply this thinking throughout the working life of a superannuation member so I did this little exercise. I know this has probably been done to death by the lifecycle investment gurus out there but I thought I’d see for myself what I would …