The biggest market in the world, often represented by the S&P 500 index, crashed pretty quickly from 24 February reaching its bottom on 23 March. This fall, in US Dollars, was around 34%. Since then, it has bounced back by around 25% after almost 5 weeks … not a bad turnaround, but obviously not back …

Category Archive: Equities

Mar 19

Most markets are mostly efficient most of the time … maybe not so much now

Its clearly been a long time since I updated this blog and perhaps this current crisis makes most sense to make a comeback; particularly given I started this blog not long after the worst of the GFC (Jan 2009 to be precise). Anyway, the current crisis has clearly required a global response to slow down …

Aug 29

Beware the Benchmark Hugger … it might be you?

Background For quite a few years now, many commentators and researchers have criticized active strategies that charge active fees to receive benchmark-like returns. If a portfolio looks a lot like the benchmark it is trying to outperform, it doesn’t mean there won’t be outperformance, but after taking fees into consideration it is much more difficult. …

Feb 13

Economic Growth & Sharemarket Returns … looking for relationships

Background According to (Elroy Dimson, 2010) the “conventional view Is that, over the long run, corporate earnings will constitute a roughly constant share of national income, and so dividends out to grow at a similar rate to the overall economy. This suggests that fast-growing economies will experience higher growth in real dividends, and hence higher …

Aug 17

Look for the Signal amongst the Noise

Background When disappointing performance occurs, alarm bells will typically ring in the minds of investors, advisers, asset consultants and perhaps the managers themselves. Investing has only ever been a long game but thanks to the internet, the 24-hour news cycle, social media, etc. etc., it appears that success is expected to occur quickly and this …

May 30

The influence of equities on multi-asset strategies…both less and more than you think

Background Over recent years many commentators and experts have spoken of the significant risks superannuation funds are carrying with respect exposure to Australian equities. Most notable were comments a few years ago from David Murray, former Chairman of the Future Fund, and Ken Henry, former Federal Treasurer, who both said they had concerns that Australian superannuation funds …

Mar 30

Australian Equities Market from a Global Equities Perspective…quant- style

It’s well known that the Australian equity market is only around 2% of Global equity markets. When we have allocations that overweight the Australian equities asset class compared to the Global equities asset class in our portfolios, it is typically justified due to the benefits of franking credits, higher dividends, and perhaps familiarity. The primary risks associated with …

Feb 07

Some Simplisitic Australian Market Analysis … setting a forecast baseline and a few trend-lines

Like all economies, the Australian economy is always facing significant challenges. Since 1970 there has been the 1973 oil crisis and double digit inflation of the 1970s, the 1980-81 recession, further high inflation of the 1980s, crash of 1987, the recession we had to have in 1991, Asian crisis of 1998, global tech crash from …

Nov 14

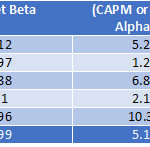

Does higher non-market risk produce higher alpha?…and the possible introduction of the Furey Ratio

Background There’s a widely held belief that to create alpha (i.e. positive returns after adjusting for risk…let’s say market risk), a manager needs to make meaningful bets away from the market. That is, stop being a “benchmark hugger”, concentrate the portfolio with best ideas, and/or move the portfolio holdings away from the benchmark and possibly …

Aug 26

Real Return funds…lacking real-ity?

What a fascinating investment world its been over the past few months. We’ve had concerns about Greece exiting the Euro, commodity price crashes, a Chinese sharemarket crash and now some of the biggest developed economy sharemarket declines since the dark days of the GFC. Volatility has been somewhat benign for a long time thanks to …