Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

Category Archive: Equities

Oct 11

Australian Bonds and Equities…who would’ve thought?

Source: Morningstar Direct, Delta Research & Advisory Over the last 5 years their performance has been pretty much the same…with the obvious exception that equities has bee a much much wilder ride. The reality of bonds in this global economy is that the outlook is still not that great from the major players (US, Japan, …

Aug 22

Low Beta Anomaly…mispricing or risk?…(a little technical)

At the Portfolio Construction Conference 2014 I had the good fortune of being on stage to discuss Ryan Taliaferro’s presentation on the Low Beta Anomaly. Now I know I’ve opened up with a lot of jargon, so in plain english…the low beta anomaly more or less says, shares that exhibit low levels of price volatility, on …

Jan 14

Cliff’s Top 10 Peeves…and a couple of my own

I know this is possibly a little old now but one of my recent favourite articles is about to be published in the Financial Analysts Journal, My Top 10 Peeves, by Cliff Asness of AQR. Just click the article name to open and read for yourself. There are quite a few gems in there but …

Jul 18

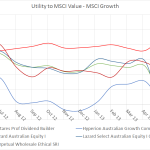

Surely the top Australian managers are “value” style…well, no!

Source: Delta Research & Advisory The above chart shows the performance of the value risk factor, which is simply calculated as the performance of the MSCI Australian Value index minus the performance of the MSCI Australian Growth index. With an ending value great than 15% than the starting value, clearly the 2013 financial year was …

Jul 18

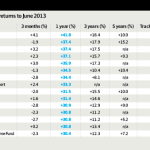

Past performance is no indication of…

Source: Australian Financial Review The above table was published in yesterday’s Australian Financial Review (the sourced link takes you there but you may need a subscription) and Lazard Select Equity is the top performer over the last 12 months, and from the other funds in this table, its number one over the past 3 …

Jul 12

RIMSec July Research Report

It has certainly been a while since I posted and, no, this blog is still active and hopefully I’ll be able to produce some good stuff sooner than later. Lots of analysis done, some interesting stuff too, just need the time to write it up. Anyway, I digress… I’ve just finished a short little Research …

May 31

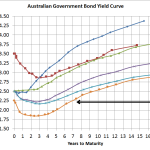

Australian Government Bond Yield Curve…plus a bit on lifetime annuities

Source: RBA, Delta Research & Advisory Not too many posts in recent times and its been a while since I looked at the yield curve and I have to admit that after scanning the various newspapers I was expecting to see some significant moves. As the above chart shows, the curve has barely moved in …

May 14

Rimsec May Research Report

The Rimsec Monthly Research report came out today which has commentary on current investment market themes, interest rate thoughts and some information on one of the significant risks within China…their property bubble. Anyway, if it is of interest you can download it by clicking here. Send article as PDF

May 06

Australian Government Bond Yield Curve…pointing to lower rates

Source: RBA, Delta Research & Advisory Whilst there has been so much talk about how funds are flowing out of bonds into equities there is little sign of it in the markets. The above chart shows Australian Government yields near the low levels of last June when the Eurozone was looking like blowing up creating …