At the Portfolio Construction Conference 2014 I had the good fortune of being on stage to discuss Ryan Taliaferro’s presentation on the Low Beta Anomaly. Now I know I’ve opened up with a lot of jargon, so in plain english…the low beta anomaly more or less says, shares that exhibit low levels of price volatility, on average, outperform shares with high volatility. Its an anomaly because if we accept volatility as a proxy for risk (which we have done for decades), then you would expect highly volatile stocks to outperform, not the other way around, because investment theory says to get high returns requires high risk.

One of the presentation’s conclusions was that this anomaly is a mispricing and is likely to persist because fund managers are inclined to hug benchmarks and avoid the tracking error (that is, significant deviations from benchmark returns) from low volatility stocks, therefore highly volatile stocks are overpriced due to over-attention. The variability in most portfolios are primarily driven by the variability in the most volatile investments so it is plausible that avoiding highly volatile stocks could be perceived of increasing a fund manager’s chances of underperformance which obviously increase their chance of unemployment.

A second conclusion was that the anomaly cannot be explained as a risk…which I have to admit is not easy to wrap your head around…but…this is where I have a slight disagreement. I say slight because whilst I do believe low volatility stocks carry a risk that does not exist in high volatility stocks, I don’t believe this risk explains all of the outperformance and is more of a contributing factor.

So here goes my explanation…

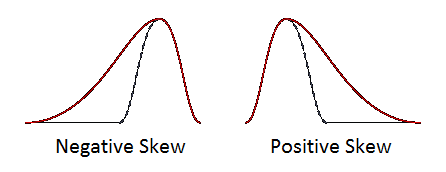

It is acknowledged that high volatility stocks have somewhat of a lottery preference amongst investors…in other words they are attractive because they have the most potential for that big win…lets face it, you have a better chance of tripling your money (or better) with a highly volatile stock than a low volatile stock. In fact, return analysis shows that highly volatile stocks have a positive skew which is a defining characteristic of lottery preference. On the flipside, the broader sharemarket and low volatile stocks have a negative skew…and investors do not desire a negative skew of returns. So increased likelihood of negative skewness is a “risk” and therefore should be compensated…hence compensation for negative skewness may be a contributing factor towards explaining the outperformance of low volatility stock compared to high volatility stocks.

Whilst buying a lottery ticket is an example of purchasing positive skewness (albeit also an irrational chance of a big return) lets not completely dismiss this phenomenon as an insane purchase as there are many positive skew purchases everyone makes that have an expected negative return…and it can be summed up in one word…insurance. Whether it be car insurance, life insurance, or any other, the expected return in the long run is negative but we still pay for it. In financial markets, the purchase of a put option (which may be an insurance contract on a poor performing market) is very expensive and is typically priced in favour of the seller and not the buyer…why?…because of the cost of positive skewness that the put option (or insurance) can bring to your investment portfolio (or circumstances). Positive skewness is a cost and that cost is applied to high volatile stocks and therefore contributes to their lower returns.

So whilst I don’t dispute the key empirical results…that low volatility stocks outperform highly volatile stocks (and this is common across many markets)…there is a deeper message to this discussion. It is, whilst volatility is a good measure of risk (and probably the best measure we have, particularly for liquid assets), it does not explain all of an asset’s risk. The stock market is not normally distributed and its volatility only tells part of the story. In fact, this is a significant factor to why the world got in trouble from the financial engineers that mispriced CDOs which ultimately led to the collapse of Lehman Brothers and others. The stock market is negatively skewed…that is not desirable; plus the stock market has many large positive and negative returns (which relates to the volatility of volatility and is called kurtosis)…that is also not desirable. The key message is that these higher moments, skewness and kurtosis, should be ignored at your peril when considering investment risk.

2 pings