ES Investing Possibly the biggest trend in investing today is the shift towards ES investing. No, that’s not a typo because it is the E (Environmental) and S (Social) factors of ESG investing that are experiencing the greatest focus as humankind faces existential threat from climate change (i.e. E) and numerous social issues, whether racism, …

Category Archive: Risk

Apr 24

Worry about Valuations??? … yeah, a bit …

The biggest market in the world, often represented by the S&P 500 index, crashed pretty quickly from 24 February reaching its bottom on 23 March. This fall, in US Dollars, was around 34%. Since then, it has bounced back by around 25% after almost 5 weeks … not a bad turnaround, but obviously not back …

May 31

A Few Investment Selection Faux Pas

Over the years having worked in consulting and research I have been sent countless portfolios for opinion. Virtually all portfolios have followed a pre-defined asset allocation aligned to a specific risk profile but occasionally that is where the alignment ends. This is because the investments selected bear little to no relationship with their desired characteristics …

Apr 27

From Asset Allocation to Risk Allocation

Background After capital market forecasts and assessing investor objectives, the current method for portfolio construction starts with the asset allocation decision followed by investment selection. In the Australian financial planning industry, it widely accepted that the asset allocation decision is responsible for most of the portfolio performance variability, and it is, rightly or wrongly, regarded …

Mar 14

Diversification … clearing up what it is and what it isn’t

Diversification is one of the central tenets of investment management and fundamental beliefs across the global financial planning industry. Its validity was set in stone by Harry Markowitz in his PhD dissertation and 1952 Journal of Finance article, Portfolio Selection, which demonstrated the effects of combining uncorrelated assets … i.e. improvement in the portfolio’s return …

Aug 17

Look for the Signal amongst the Noise

Background When disappointing performance occurs, alarm bells will typically ring in the minds of investors, advisers, asset consultants and perhaps the managers themselves. Investing has only ever been a long game but thanks to the internet, the 24-hour news cycle, social media, etc. etc., it appears that success is expected to occur quickly and this …

May 30

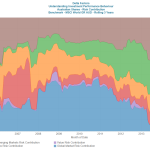

The influence of equities on multi-asset strategies…both less and more than you think

Background Over recent years many commentators and experts have spoken of the significant risks superannuation funds are carrying with respect exposure to Australian equities. Most notable were comments a few years ago from David Murray, former Chairman of the Future Fund, and Ken Henry, former Federal Treasurer, who both said they had concerns that Australian superannuation funds …

Mar 30

Australian Equities Market from a Global Equities Perspective…quant- style

It’s well known that the Australian equity market is only around 2% of Global equity markets. When we have allocations that overweight the Australian equities asset class compared to the Global equities asset class in our portfolios, it is typically justified due to the benefits of franking credits, higher dividends, and perhaps familiarity. The primary risks associated with …

Sep 27

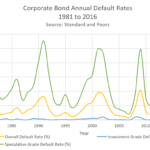

Bill Gross leaves PIMCO…might lead to a downgrade or two

Irrespective of the quality of the rest of the firm, and there is a lot of quality, with the departure of Mohammed El Erian at the start of the year and now Bill Gross, it doesn’t take much to guess there may be a little destabilisation at the PIMCO offices for a while. Whilst Bill …

Aug 22

Low Beta Anomaly…mispricing or risk?…(a little technical)

At the Portfolio Construction Conference 2014 I had the good fortune of being on stage to discuss Ryan Taliaferro’s presentation on the Low Beta Anomaly. Now I know I’ve opened up with a lot of jargon, so in plain english…the low beta anomaly more or less says, shares that exhibit low levels of price volatility, on …