Source: RBA

I know this probably an overly simplistic way of looking at investment grade credit markets…but…the above chart is currently showing that US investment Grade credit spreads have declined to be in the ballpark of pre-GFC levels. Personally, the US economy is still relatively weak, albeit getting stronger, but I no longer believe this type of credit risk appears as good value and today I would rather own safer US Treasuries than US Corporate debt…why…greater protection alongside of riskier assets such as equities, therefore as far as I’m concerned Treasuries have a better risk-adjusted expected return.

According to Moody’s the worst default rate of BBB rated securities over the last 30 years was a little over 1% which occurred in 2002. The current spread provides a little more than that so there is only a little compensation for other risks such as illiquidity if things go tech-crash pear shape.

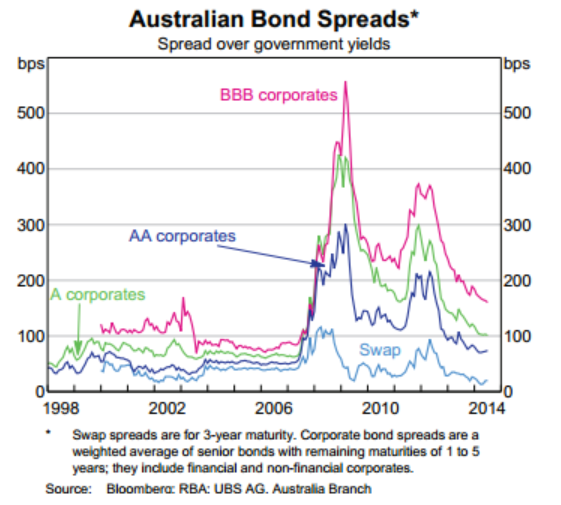

Anyway, no matter how you look at it the chase for yield from lower rated credit risk is definitely approaching its end and whilst Australian credit looks a little better or wider (see below chart), our unemployment rate didn’t increase to 6.4% for nothing…that is, our investment grade debt should have a wider spread as our economy is looking like doing nothing more in the next couple of years but weakening.

Source: RBA

6 pings