Source: RBA

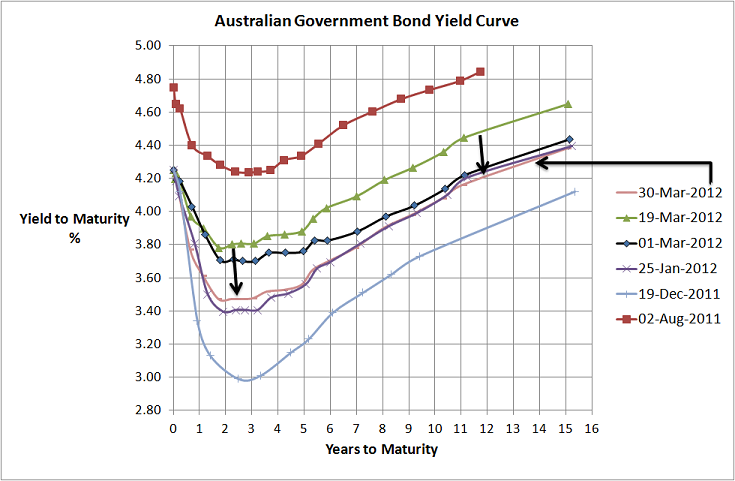

In less than two weeks the yield curve managed to drop around 15bps back to levels similar to those of late January. This is despite slightly stronger equity markets, the ASX200 made it through the 4,300 barrier for the first time in many months, and not that much in the way of really bad news…I would have thought that no really bad news is actually good news.

Anyway, the good news really is that nothing terribly horrible has come out of either Europe or USA, however the not so good news is that our economy is probably softer than many realise. As a nation we are largely a one trick pony, thanks to the Chinese commodities story and our financial services sector is struggling along with many other sectors, that include (but not limited to) manufacturing, tourism, and retail. So if commodity prices come off or Chinese growth looks to slow more than expected than our economy is not going to look as rosy as it would otherwise.

Back to the chart….this reduction in bond yields is confirmation of the weaker Australian economy and in my humble opinion it appears to be somewhat of a late cry for help to the RBA for it to reduce interest rates tomorrow. I’m not convinced this will happen, although with the Gillard government so stupidly focused on a fiscal surplus as soon as possible (despite the aforementioned struggling sectors) then the RBA may have to provide some untargeted assistance by way of a 25bps rate cut sooner than later. I emphasise “untargeted” because monetary policy is a blunter tool than fiscal policy which has the ability to be a little more targeted to the strugglers…well at least an interest rate decrease might reduce the dollar. Anyway, I digress…given European market’s good behaviour (which is different to its economic behaviour) I do believe rates will stay but the bad Gillard/Swan behaviour may change things.