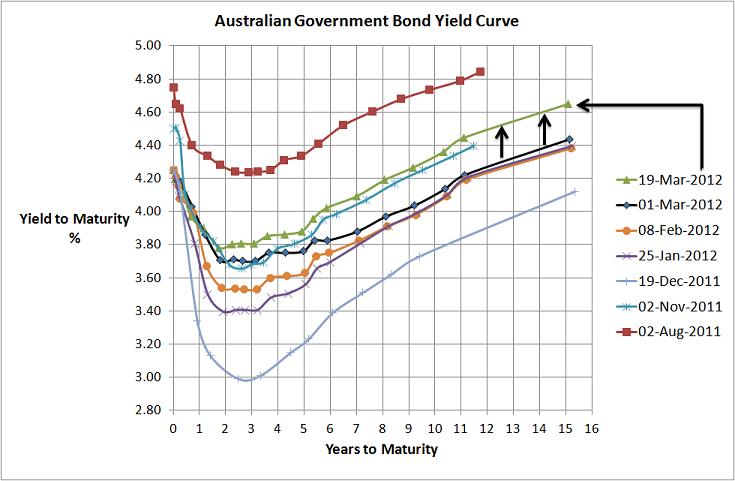

Well…not normal yet. The shorter part of the curve suggests the market is expecting another two 25bps cuts by the RBA but with the Euro sovereign crisis well and truly looking much better its highly unlikely there’ll be any cuts soon. Whilst there’s plenty of evidence that shows the Euro sovereign crisis has improved, nothing does so more than the decline in Italian 10 year bond yields from over 7% a few months ago down to 4.83% overnight…truly a good recovery to confidence but there’s still a long way to go.

Europe is undoubtedly in recession, the austerity programs are proving disastrous without anything to produce growth except hope…not much of a plan. Youth unemployment in Greece and Spain is over 50% and its getting up there in many of the other troubles European economies…there is little doubt that the social unrest we have seen in Greece in recent times will continue and it will ignite in other countries as well…Europe has all sorts of troubles and there’s a long way to go before normality exists.

The unemployment issue in the USA has definitely shown improvement over the last couple of months but keep in mind some of that is due to people withdrawing from the workforce which artificially deflates the unemployment result. Anyway, the jobs growth is still an improvement on last year, the decline in housing has stalled, and Bernanke is keeping rates at 0 for a couple more years. The biggest concern for the US is the continued withdrawal of government stimulus that will be an ongoing headwind to economic growth and I believe some of the Bush tax cuts are withdrawn in January 2013 which apparently will produce a 3% hit to GDP….plenty of headwinds.

As for Australia, my personal view is that the overall economy is going ok but the headlines that I’ve been reading suggest that our low unemployment levels will be at risk. With our housing market and sharemarket declining over the last year, household wealth is down; if unemployment spikes then this could be a psychological hit to our confidence that we haven’t seen for some time. I’ll be keeping an eye on unemployment.

As for markets, despite the increase in the sharemarket this year, I’ve seen enough to increase my longer term weighting to risky assets. I do believe volatility is still too low, but I’m more comfortable with the longer term outlook for shares than I have been for a long time (can’t remember when to be honest). As for government bonds…as the above chart shows, the yield increases means the prices have decreased and its not where I want my long term money to be today. So yep, I’m giving the kiss of death to risky assets and am more comfortable to increasing their allocation than I have been for ages.