Background Over recent years many commentators and experts have spoken of the significant risks superannuation funds are carrying with respect exposure to Australian equities. Most notable were comments a few years ago from David Murray, former Chairman of the Future Fund, and Ken Henry, former Federal Treasurer, who both said they had concerns that Australian superannuation funds …

Category Archive: Investment Strategy

Feb 07

Some Simplisitic Australian Market Analysis … setting a forecast baseline and a few trend-lines

Like all economies, the Australian economy is always facing significant challenges. Since 1970 there has been the 1973 oil crisis and double digit inflation of the 1970s, the 1980-81 recession, further high inflation of the 1980s, crash of 1987, the recession we had to have in 1991, Asian crisis of 1998, global tech crash from …

Nov 14

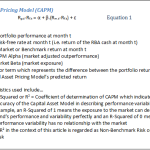

Does higher non-market risk produce higher alpha?…and the possible introduction of the Furey Ratio

Background There’s a widely held belief that to create alpha (i.e. positive returns after adjusting for risk…let’s say market risk), a manager needs to make meaningful bets away from the market. That is, stop being a “benchmark hugger”, concentrate the portfolio with best ideas, and/or move the portfolio holdings away from the benchmark and possibly …

Nov 07

The importance of asset allocation in Australia…BHB revisited

We’ve all seen various developments in product design from hedge funds to long/short to real return approaches, and then there’s the increased focus on tactical and dynamic asset allocation. You would expect all of this to lead to different drivers of portfolio risk…i.e. away from traditional asset class drivers to market timing, investment selection, and …

Sep 20

A widely accepted portfolio construction flaw

The typical approach to portfolio construction in the world of financial planning is a 2-step process (of course, this is after the desired risk and return characteristics are settled). The first step is setting asset allocation and the second is investment selection where most of the industry chooses to select from a variety of managed fund strategies. …

Aug 26

Real Return funds…lacking real-ity?

What a fascinating investment world its been over the past few months. We’ve had concerns about Greece exiting the Euro, commodity price crashes, a Chinese sharemarket crash and now some of the biggest developed economy sharemarket declines since the dark days of the GFC. Volatility has been somewhat benign for a long time thanks to …

Feb 21

A few simple thoughts on a few not so simple markets

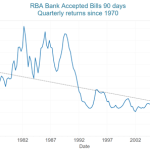

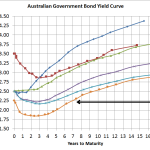

Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

Nov 13

Industry Super Funds, Transparency…and stretching the truth a little

One of the bigger frustrations for advisers is the lack of transparency of industry super funds. Advisers and researchers do not have deep access to their investment processes, often with little understanding as to what comprises an investment strategy beyond anything other than the asset allocation. As a result, in general advisers don’t recommend industry super …

Nov 08

Merton’s Retirement Income Views…correct but its not a product solution…its an advice solution!!!

Nobel laureate economist Robert Merton says David Murray’s Financial System Inquiry must fundamentally shift how Australia thinks about superannuation. He says the desire to maximise lump-sum balances at retirement is excessively risky; the focus should be on ensuring retirement income is enough to meet a desired standing of living. Source: AFR – 6 Nov 2014 …

Aug 07

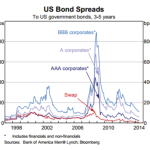

The disappearing credit spread…US now at pre-GFC levels

Source: RBA I know this probably an overly simplistic way of looking at investment grade credit markets…but…the above chart is currently showing that US investment Grade credit spreads have declined to be in the ballpark of pre-GFC levels. Personally, the US economy is still relatively weak, albeit getting stronger, but I no longer believe this …