Its been over a week since I posted so I thought I’d write about something that is a little bit different and hopefully may provide a little bit of food for thought.

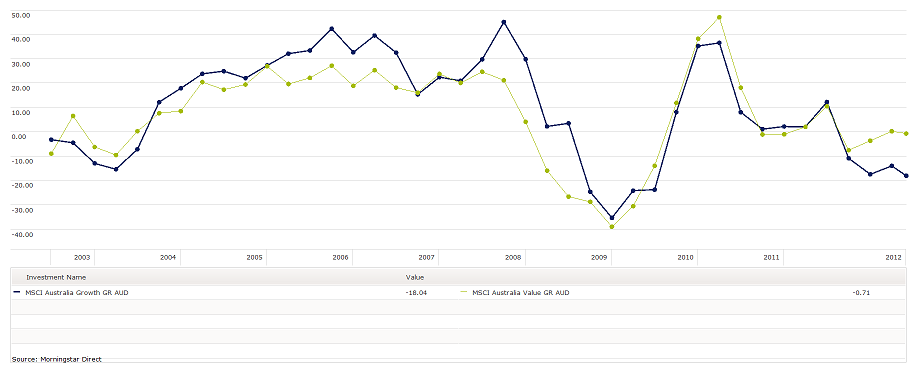

The above chart shows the performance of the MSCI Australia Value index (dominated by low PE stocks) vs MSCI Australia Growth index (dominated by strong earning growth stocks) over the last 10 years. Each dot point is three months apart and represents the 12 month performance of the respective index. What the chart shows iis that over the last 10 years the MSCI Australia Growth index has mostly outperformed the value index, surprisingly including during the Lehman Brothers period of 2008/09. I say surprising because often it is the Growth stocks (i.e. those with a higher earnings growth performance and expectation) that will fall the most as growth projections are downgraded .

Despite the dominance of the growth index over the 10 years, the last 18 months to 2 years has seen a significant divergence between the two indices and the Value index has massively outperformed Growth. In the 12 months to the end of May 2012, the performance of the Value index is only just negative (-0.71%) whereas the growth index is a disappointing loss of more than 18%.

There is a belief by many that the Australian sharemarket is too small to differentiate between value and growth stocks, but given the recent divergence in performance I’m not so sure…anyway…

So what? you may ask.

Well, this divergence explains why certain fund managers are top of the league table why others are at the bottom and it is the fund manager’s style bias that has recently been more important than any actual stockpicking or timing skill. For example, my analysis shows that Lazard Australian Equities is amongst the top performing Australian equities managers because it has embraced the Value style but unfortunately its “Alpha” over recent years is negative…so in my mind they haven’t produced sufficient skill to justify their fees. On the other hand, Macquarie High Conviction has shown a strong bias towards the Growth style and after this bias is taken into consideration there has been a positive alpha (or skill) according to my statistical analysis so there is an actual value add there worthy of consideration….however, because of their style leaning to growth stocks, they have been one of the worst performing Australian share managers over the past 12 months.

Ok…so…the point of this is that style matters and can matter more than skill and should be a consideration in terms of your market expectations and how you would like to position your investment portfolios. For me, I’m expecting sharemarket volatility to continue and I believe there is a strong chance that growth forecasts may continue to decline so I am currently favouring the value style over growth. The next questions I need to ask are…which managers actually implement a value style, are likely to continue that style, and have the ability to pick the stocks that can justify their fees?