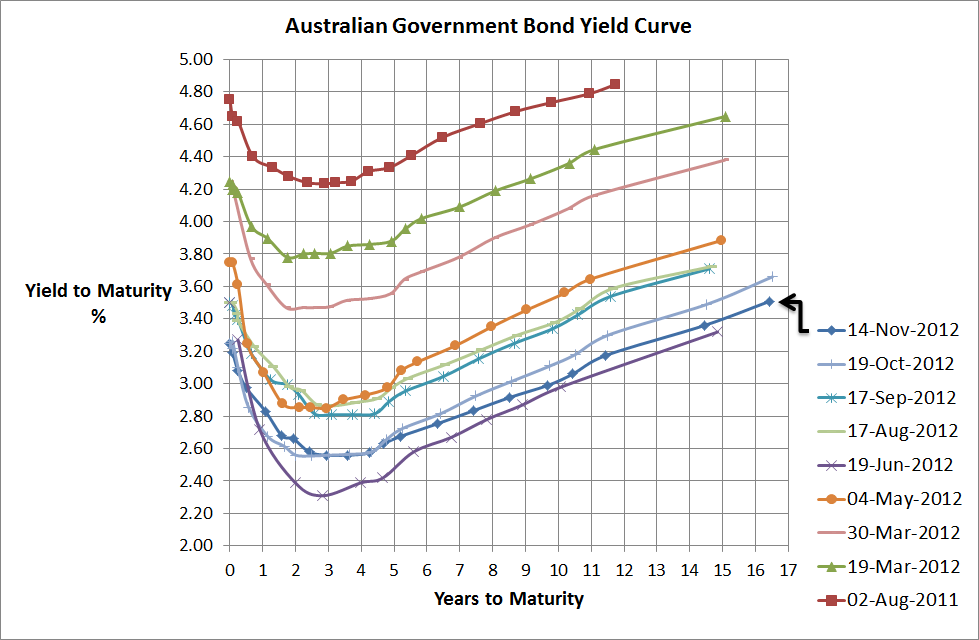

I’ve uploaded the above chart in preparation for a presentation I’m giving tomorrow on portfolio construction. Anyway, the message isn’t really a great deal different from previous posts commenting on the Government bond yield curve. Namely,

- Interest rates are very low…you should be able to get some nice low fixed interest rates for your home loan around the 3,4, and 5 year mark

- Inflation appears to be a non-issue

- The bond market expects RBA cash rates to get much lower…dare I say it…2.5% within the next couple of years..to be honest, I hope not

- The Australian economy isn’t as strong as many of us believe

- Looks like there’s still a lot of overseas demand in these things hence why the Aussie dollar is still high

Anyway, its not a particularly rosy picture so there’s still a few concerns around…Fiscal Cliff, China slowdown, Greek Euro Exit, Failing austerity in Europe, and middle east tensions…they’re certainly a lot more concerning than the general risks expected preceding the GFC (I say expected because let’s face it, very few of us had little idea the collapse of subprime mortgages in the US were going to start the biggest recession since the Great Depression).