Reaction to 3 year bond price in the first chart below … that’s still a 0.5% yield to maturity. So the RBA are saying they want 0.25% yield to maturity which is a high bond price but only little bit of interest in the first 5 minutes or so off the bat.

Source: Bloomberg

Source: Bloomberg

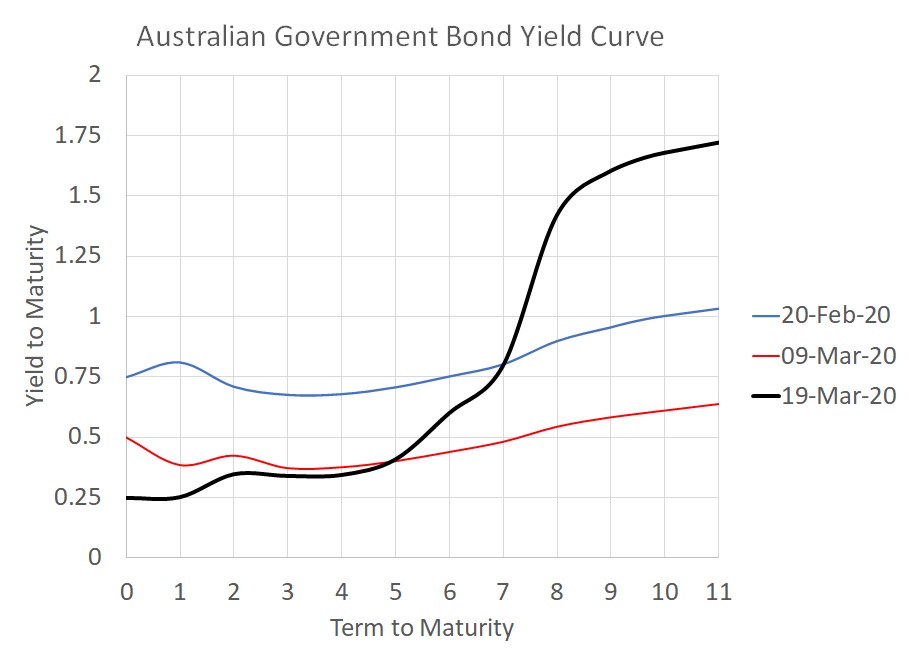

A little bit later the following chart shows what the Australian Government Yield curve looks like. To me, this is bizarre (or an inefficient market).

It confirms what I believe is a complete mis-pricing at the longer end of the curve (see last post) … 10 year bond yields are now trading at 1.7% which appears way too high given the recession we are currently in … and the shorter end of the curve is heading towards the RBA’s 0.25% target where buying commences tomorrow on the 3-year bond. Currently (3.11pm ADST) the 3 year bond is yielding 0.34% so is on the way down from the initial 0.5% … as you’d expect.

Source: Delta Research & Advisory, Bloomberg

Source: Delta Research & Advisory, Bloomberg