We’ve all seen various developments in product design from hedge funds to long/short to real return approaches, and then there’s the increased focus on tactical and dynamic asset allocation. You would expect all of this to lead to different drivers of portfolio risk…i.e. away from traditional asset class drivers to market timing, investment selection, and …

Tag Archive: Investment Strategy

Sep 20

A widely accepted portfolio construction flaw

The typical approach to portfolio construction in the world of financial planning is a 2-step process (of course, this is after the desired risk and return characteristics are settled). The first step is setting asset allocation and the second is investment selection where most of the industry chooses to select from a variety of managed fund strategies. …

Aug 26

Real Return funds…lacking real-ity?

What a fascinating investment world its been over the past few months. We’ve had concerns about Greece exiting the Euro, commodity price crashes, a Chinese sharemarket crash and now some of the biggest developed economy sharemarket declines since the dark days of the GFC. Volatility has been somewhat benign for a long time thanks to …

Feb 21

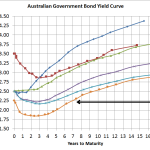

A few simple thoughts on a few not so simple markets

Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

Nov 13

Industry Super Funds, Transparency…and stretching the truth a little

One of the bigger frustrations for advisers is the lack of transparency of industry super funds. Advisers and researchers do not have deep access to their investment processes, often with little understanding as to what comprises an investment strategy beyond anything other than the asset allocation. As a result, in general advisers don’t recommend industry super …

Aug 01

Ramblings about Unconstrained Debt Funds and Portfolio Construction…wonkish and a work in progress

I’ve just returned from a manager research trip in the UK where we visited a variety of strategies from a variety of managers and fortunately for me, with some of the leading thinkers and researchers in the advice industry (hat tip D&G … and I don’t mean Dolce and Gabbana). Several of the managers we …

Jun 14

Market Cap Weighted Bond Indices…always tough to beat

The common criticism of market-cap weighted bond indices is that they are inefficient because they are obviously weighted towards those with the most debt. Thus indicating that the index potentially carries more risk than necessary, or than we may want in a portfolio, because those with the most debt carry greater default risk than those with very …

May 09

How often should we rebalance portfolios?

It appears that the financial planning industry is a big believer in rebalancing but a little unsure as to how often. Some accept the automatic quarterly option, some rebalance at the client review, some annual, or even at 13 months to potentially reduce capital gains tax by taking advantage of the 50% CGT discount. Because the …

May 05

Revisiting Asset Weighted Returns and the Lifecycle Fund

Given the start of MySuper this year, superannuation trustees have released numerous lifecycle funds to satisfy this new legislation. Whilst lifecycle funds have been popular among superannuation trustees, the investment and adviser community haven’t been so complimentary. Either way, lifecycle funds definitely have a place in the investment landscape and they provide an approach to …

Apr 24

Absolute return investing…a nice goal but disappointment is likely

Absolute return investing, according to many definitions, is about getting positive returns irrespective of the overlying “market” return of whatever asset class the investor is being exposed to. This essentially means that any “absolute” returning investment needs to employ strategies that are independent of market direction. For example, if the market (and it can be …