There’s a brief article in today’s Investor Daily News that comments on “Managed Volatility” being the strategy to maximise returns…article here. I have to admit that I believe this strategy will be one of the new trends in equity focused managed funds over the next 12 months or so. Empirical evidence over the years the …

Category Archive: Managed Funds

Nov 08

Does Value offer much Value? … this is a discussion on equities performance

Source: MorningstarDirect The above chart shows the performance of the MSCI Australia Value index versus the MSCI Australia Growth index over the last 12 months (in fact through to close of trading yesterday). There’s obviously a hug divergence in performance as the Value index has returned more than 21% whilst the Growth index has barely …

Sep 13

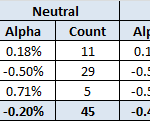

Australian Share Managers – Alpha and Risk Factors

My new company, Delta Research & Advisory, has recently conducted some risk factor analysis of Australian fund managers and it is starting to yield some interesting results. We’ve analysed around 120 managers using Fama/French-like risk factors where thhe value/growth factor is simply MSCI Australian Value index minus MSCI Australia Growth index and the Size factor is MSCI Australia …

Sep 04

Modern Portfolio Theory – Passive versus Active…again!

Not a great deal of posting the last couple of months due to a combination of conferences, flu, and just plain busy so hopefully I can increase the frequency moving forward. A couple of weeks ago I was at a conference and Modern Portfolio Theory was receiving an absolute caning from those on stage. They …

Aug 02

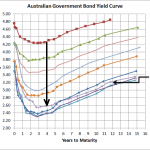

Australian Government Bond Yield Curve…slight increase but risks remain

Source:RBA The above chart shows that over the last few weeks there has been an increase of around 10-25bps across the yield curve which is also in line with the marginally stronger equity markets. As I’ve stated numerous times before, the European situation is what is currently driving most major market moves and the partial …

Jun 27

Australian Equities Style Investing – Value vs Growth

Its been over a week since I posted so I thought I’d write about something that is a little bit different and hopefully may provide a little bit of food for thought. The above chart shows the performance of the MSCI Australia Value index (dominated by low PE stocks) vs MSCI Australia Growth index (dominated …

Mar 10

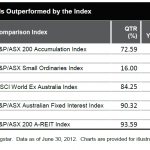

SPIVA…Australian Small Cap managers demonstrate skill

The SPIVA report was released a few days ago and as I’ve mentioend before it is my favourite assessment of the success of fund managers because it takes into consideration survivorship bias…in other words, if you want to know who are the best fund managers over the last year, then you start with all fund …

Feb 20

Excellent long term performance from bonds…but there’s a lot more to it

A look at the average returns of bonds over the last 30 years does not suggest that equity returns have really been worth the risk. Table 1 shows the returns on Australian Bonds (Aust Comm Bank All Series/All Maturities) versus the accumulated return of the Australian sharemarket (S&P/ASX 200 TR) and whilst equities have the better performance …

Feb 16

Platinum Asset Management…they’re good but also a tad greedy

Platinum Asset Management is undoubtedly the most successful International shares manager in Australia. Their long term performance is way above global benchmarks and thanks to this, their support has been unwavering and they have grown and grown to be one of Australia’s largest fund managers with over $18 billion in FUM. Unfortunately like most companies …

Jan 25

Managing Market Risk using Variable Beta Funds

Lonsec have a reasonable investment strategy paper released today (subscription required) suggesting one of the best ways of managing equity market risk is to use variable beta managers. A variable beta manager is a manager who has the ability to significantly change their exposure to the market depending on their view. So if a variable …