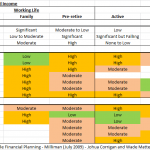

Found the above heat map in an interesting article on life cycle financial planning on Milliman’s website … click here for the article. I think the heat map speaks for itself…(although apologies for the spelling errors..my bad)…and clearly points out the risks that generally need to be addressed at various points in time. As the …

Category Archive: Financial Planning

May 20

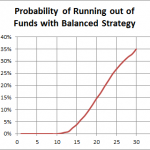

Being a millionaire may not be enough for a comfortable retirement

Source: Delta Research & Advisory Pty Ltd The above chart shows the probability of running out of funds in retirement for someone who retires with $1,000,000 in today’s dollar and draws $55,080 each year (ASFA Retirement Standard for a comfortable retirement for a couple), growing at 3% inflation. It is assumed the funds are invested …

Apr 16

Retirement Income Portfolios – poorly understood

One of the debates in the financial services media has been around the investment strategy of superannuation funds and whether they are holding too many equities. In the camp of too many equities is former Head of Treasury, Ken Henry, nd former Chairman of the Future Fund, David Murray; and opposing views have typically been …

Mar 27

Does our Super have too much in equities?

Over the last couple of weeks I’ve been asked to comment on the asset allocations of default super funds. There’s certainly been a very interesting debate through the print media which was probably started by David Murray, Chairman of the Future Fund, last year when he stated that Austrlaian Super Funds were too heavily invested …

Mar 04

Portfolio vs Asset Allocation…potential pitfalls

Many financial planners recommend their clients follow a particular Strategic Asset Allocation that may be based on the output of the combination of a risk profile as well as matching the client’s needs. For example, a popular strategic asset allocation for a “balanced” portfolio may be along the lines of… Australian Shares 35% Global Shares …

Jan 15

Bond ETFs on the ASX…now the game begins

With the ASX last week announcing that it is allowing bond ETFs to trade on the market, financial planners have the last basic building block in place to recommend portfolios that are completely listed covering all major asset classes. Previously listed portfolios were limited to equities (local and global of varying strategies) and commodities. With …

Jan 14

Promoting the wrong Financial Planners

Sorry about this article but i have to express my disgust at an article I’ve just read on a former Storm Financial adviser in today’s Sydney Morning Herald…I reluctantly place the link here but I don’t want to give any more publicity to this adviser. Overall the article, by Stuart Washington, is quite fair and …

Jan 14

Buy-hold strategy may have had its day…I don’t think so

Page 31 of the Australian Financial Review (AFR) today has an article suggesting “that the traditional buy-hold approach to owning shares is dead”…full text, with subscription can be found here. The article’s stated reason for buy-hold is that “in the long run, markets always go up and will provide investors with a good return on …

Jan 04

Investment Thoughts for 2012

Firstly I think its appropriate to suggest that I intend to make no return predictions for this year as I do believe its pretty much impossible with litte upside for me. However, what I would like to do is simply point out a few facts, rules, and current issues that need to be considered when …

Sep 12

More on Asset weighted vs Time Weighted Returns

I just did some simple analysis of balanced fund returns and on a time weighted basis (excluding tax), balanced funds returned on average a compound monthly return of 0.38% in the ten years to the end of August 2011. This is equivalent of a compound annual growth rate of approximately 4.7%. I then assumed the …