Background

After capital market forecasts and assessing investor objectives, the current method for portfolio construction starts with the asset allocation decision followed by investment selection. In the Australian financial planning industry, it widely accepted that the asset allocation decision is responsible for most of the portfolio performance variability, and it is, rightly or wrongly, regarded as the most important investment decision. Asset classes are then populated with investments and the portfolio is recommended to a client.

Unfortunately, there is one major problem with this two-step approach. The investments chosen often do not reflect the required asset allocation and the asset allocation decision becomes compromised. This is because Asset Allocation is a “Market Beta” decision whilst the Investment Selection may introduce an “Alpha” component which can change the exposure to the desired asset classes. An investment manager looks to add value, loosely defined as “Alpha”, by designing portfolios that differ from the market. The size of these non-market bets may capture certain risks that are positively rewarded but it may also introduce unintended risks so that the final portfolio not only doesn’t represent the asset allocation, it might increase risks that result in a worse than market outcome in stressed times.

This portfolio construction problem can be summarised by the following equation:

Asset Allocation ≠ Investment Selection because Beta ≠ Alpha + Beta.

This problem can be solved in two ways:

- Remove the Alpha component of Investment Selection. This means the chosen investments are simply index funds that represent their respective asset classes. Many financial planners already do this, as they may believe markets are efficient and/or that active management does not add value amongst other reasons. This transforms the above equation to: Asset Allocation = Investment Selection because Beta = Beta

- Introduce a formal Alpha Allocation component to the process, changing the equation to be Alpha + Beta = Alpha + Beta. The goal is then to choose investments that specifically reflect the asset class and alpha allocation decisions.

This article discusses the introduction of the additional step of Alpha allocation and proposes one simple framework for its implementation. Considering today’ markets, whether bonds or equities, may be regarded as expensive with future (“Beta”) returns looking increasingly low, efficient purposeful Alpha allocation may become an essential component for adding that little bit of extra return.

Equity Risk matters most

The largest component of risk for all multi-asset portfolios comes from equity markets. It generally doesn’t matter whether a portfolio is 25% growth assets or 80% growth assets, most of the portfolio’s performance variability will come from equities. Therefore, active asset allocation approaches, must have greatest focus on the Equity Market allocation (or equity market Beta).

It’s often said when markets are running strongly, investors don’t really care whether they’re invested in index funds, benchmark-huggers, or highly active strategies. As long as they are receiving high returns they are likely to be happy. In strong markets, Alpha (or outperforming the market) matters less and it’s all about capturing the market (or “beta”).

Of course, when markets perform badly … investors don’t want “beta”, they want to be protected. They want uncorrelated assets, they want diversification away from equities risk, and they still want positive returns, and some clients may be more accepting than others, irrespective of their risk profile!

If equity markets are cheap, say based on simple, perhaps naïve metrics like Price/Book or PE Ratio measures, capturing equity market risk (or Beta) is desirable. On the other hand, if equity markets are expensive, well, it’s a lot more challenging.

But what if all asset classes have a weak return outlook and there appears little place to hide? This leads to an Alpha allocation (or non-market or specific risk allocation) decision.

Example Portfolio Construction Framework

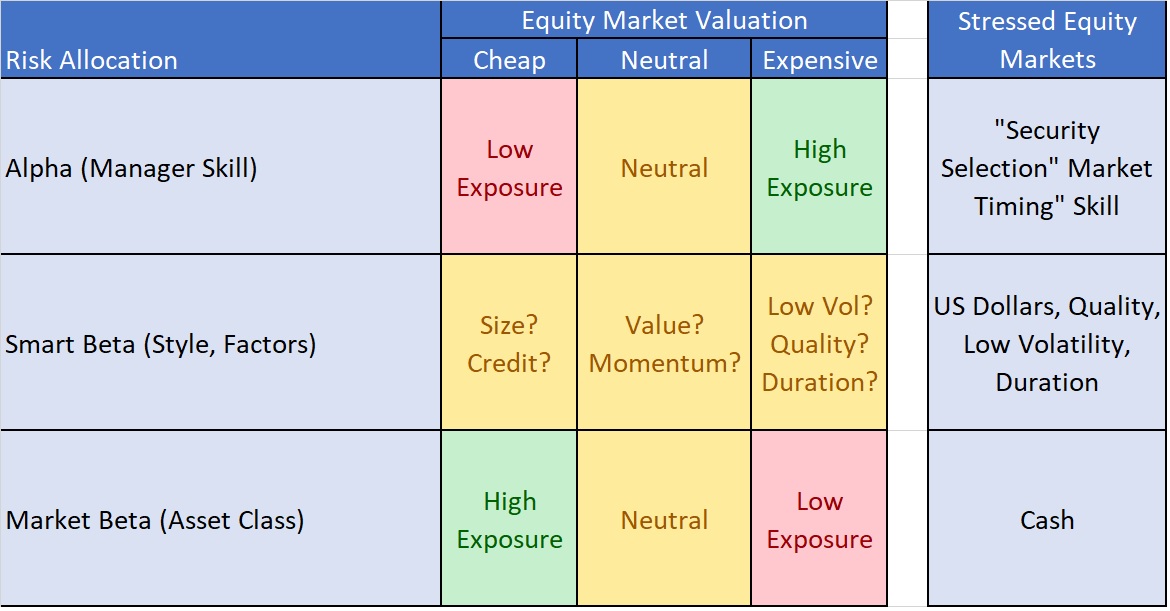

Figure 1 shows one framework that can be used for allocating between Alpha and Beta which hopefully improves process around investment selection and their alignment to a formal view. In this context, Smart Beta (which are cheap systematic risks) are separated from pure “Skill” based Alpha allocation.

Figure 1 – Active Allocation Framework

Source: Delta Research & Advisory

It should be noted up front that this framework is no guarantee of success and is an attempt at putting probabilities in the investor’s favour. Active management success will always rely on good timing and assumptions coming true, and unfortunately there are never guarantees in investing.

This framework proposes the following deeper dive within each asset class with considerations of allocation to various alpha-driving risks:

- Increased allocation to Alpha-focused strategies when equity markets are expensive

- By definition the Alpha component of a strategy’s return is uncorrelated to the market (Beta) return so increasing Alpha potential when markets are expensive may be a simple, effective risk management strategy

- Increased allocation to Beta-focused strategies (i.e. index or benchmark-hugging strategies) when equity markets are cheap

- When markets are cheap, expected returns are high so diversification to markets matter less and capturing index returns can be best

- Smart Beta (or Style/Factor biases have the potential for outperformance in all markets but it should be noted that factor timing is considered very difficult and different factors will perform better at different parts of the cycle.

- If there are concerns about equity markets becoming stressed, some of the recent Risk Allocations that have provided some downside protection include:

- Pure “Alpha” strategies focused on “market timing” and/or “security selection”. This may include Alternatives such as Hedge funds; or more specifically uncorrelated Alpha strategies such as Market Neutral or some Managed Futures strategies

- US Dollars – this may be a currency hedging decision or could be a direct cash allocation using some ETFs. Often during stressed global equity markets, funds are flowing from the riskiness of equities to the safety of US Government bonds and cash. This increases the value of the US Dollar versus the Australian dollar. An unhedged Global equity position (which has a high proportion of US Dollars) can also be cushioned somewhat by this rising US Dollar.

- Volatility – Volatility strategies do exist and are typically available via complex hedge funds, but equity market volatility increases during stressed times

- Momentum – This is the “factor” that Managed Futures strategies generally capture and is largely about capturing the current trend. So for a downturn, like during the GFC in 2008, momentum capturing strategies can produce positive returns

- Duration – This is interest rate risk. When equity markets are under stress, interest rates will sometimes decrease as equity markets are seen as a leading indicator to the economy. Declining interest rates means higher bond prices, but this applies to only the most secure or conservative bonds such as AAA-rated government bonds. Whilst Corporate bonds may have some duration risk, a stressed equity market often results in a declining corporate bond price as credit risk and equity market risk are generally highly correlated when you don’t want it to be.

- Cash – This is the only asset class that can provide a buffer for a stressed equity market. Whilst Alternatives and Bonds can, it is only specific sub-classes of investment that may diversify the stressed equity market.

This simple framework provides a deeper dive beyond asset allocation, beyond market expectations, and towards some of the more specific risks that may be uncorrelated at certain times with the most important risk of all, equity market risk. Allocating to risks that provide greater diversification to an existing asset allocation, whilst no guarantee of superior return, hopefully provides for more efficient investment selection and fills a gap that has frequently created problems in the portfolio construction process … the asset allocation and investment selection mismatch.

Final Thoughts

Many pundits today see interest rates rising, decreasing bond prices, which may ultimately lead to decreasing equity valuations. All-in-all a recipe for lower asset class returns in the future. Many portfolios were not prepared for the GFC as they were chasing returns and had exposures that were considered defensive but ended up correlated with the equity market risk of 2007 to 2009. The GFC showed that asset allocation can fail, particularly if the investment selection is not aligned appropriately. This paper proposes an additional step that allocates to risks (non-market risks) depending upon equity market valuations. It proposes a step that provides a clearer recipe for investment selection. Whilst this does not provide guarantees of superior returns, it will hopefully provide greater diversification and improved ability to withstand volatility when its most needed and capture market returns efficiently.

Side note – It should be noted this framework requires the measurement of risks for investment and advisers frequently comment in various discussion forums of the inability to measure these portfolio risks. This is not true, and there are increasingly many more tools available for measuring and understanding the risks of investments available in Australia and they can definitely aid in building these more robust portfolios. And I’ll leave my conflict of interest at this point.