The following article was published by Professional planner Magazine a couple of months ago and whilst can be found on their website by clicking here … the original article follows.

Background

One of the biggest trends in the financial planning today is the shift towards managed accounts. This is primarily an exercise in increasing efficiencies and lowering costs to serve clients, but it also has created other risks and shifted the financial planner closer to the role of fund manager. Whilst financial planners have always managed client investment portfolios, the managed account trend towards becoming more like fund managers requires a different set of skills, knowledge, and risks, that come with discretionary portfolio management.

The purpose of this article is to provide a guide to one of the foundations of quality funds management and to aid in this shift towards a more professional approach to all things investing … the Investment Policy Statement (IPS).

What is an Investment Policy Statement (IPS)

An Investment Policy Statement defines the rules of investment portfolio management. That said, it can easily apply to all investment decisions whether it be model portfolios, construction of approved product lists, or the management of a self-managed superannuation fund. Establishing a comprehensive IPS, irrespective of purpose, is a step towards stronger risk management and governance of all investment businesses whether implementing managed accounts or traditional investment advice approaches.

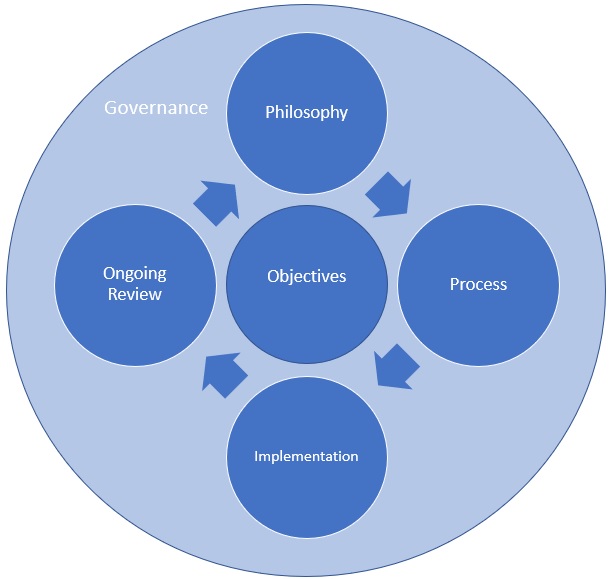

Chart 1 shows one version of the structure of an IPS. Central to the IPS are the objectives, with surrounding components designed to maximise the achievement of those objectives. Namely, Philosophy, Process, Implementation and the Ongoing Review. Covering all aspects of the IPS is a system of Governance focused on execution and accountability of all policies. Following are descriptions of each of these components. Please note, this article does not provide a comprehensive description of everything involved in the design and execution of the IPS and serves as an initial guide to lay the foundations towards better investment decisions and ultimately, investment portfolios.

Governance

Across the investment industry, the governance function is usually performed by the Investment Committee which is a specialist sub-committee of the business’s Australian Financial Services License (AFSL). The Investment Committee owns the IPS, is responsible for its creation, and ensures it is executed accordingly. Whilst there may be portfolio management, analysts, external consultants, and/or an internal Research department, the investment committee’s responsibility is to hold them accountable for the day-to-day running of investment activities.

The investment committee is typically established by way of an investment committee charter, that may for part of the IPS, that outlines the following:

- Committee membership and voting rights. This may include:

- Senior management

- Compliance/Legal/Risk Management representation

- Portfolio Management

- Independent experts

- Committee purpose – Ownership and implementation of the IPS which includes:

- Strategy development

- Due diligence procedures for investment selection

- Investment performance review

- Sometimes operational finance and business development review

- Meetings are typically quarterly

- Minutes and all procedures are documented

- Investment and portfolio decisions are documented and communicated appropriately to stakeholders (advisers, staff, and investors)

- The committee should ideally review the overall IPS on, at least, an annual basis

The investment committee plays the most crucial role of IPS due to its role in accountability and execution. So, whilst a well-functioning investment committee is no guarantee of strong investment returns, it is a leading indicator of a firm with a strong risk management culture which should reduce the likelihood of left-field investment disasters. Similarly, whilst an IPS may look good on paper, unless its rules and procedures are adhered to, it becomes worthless and a risk to any investment-related business.

Chart 1 – Investment Policy Statement (IPS) Design

Source: Delta Research & Advisory

Objectives

Central to all investment decisions are the objectives. All investment decisions should be made with consideration of objectives and they should be defined based on the SMART principle:

- Specific … may be absolute, such as 8%pa, or relative to a benchmark, such as to outperform the S&P/ASX200 by 2%pa over 3 years

- Measurable … this seems simple enough as all investments produce performance, but when cashflows are involved it does get a little more complex and portfolio performance measurement is not perfect across managed account platforms, particularly with respect to Global Investment Performance Standards.

- Achievable … Equity markets have outperformed cash and bonds in Australia by no more than 4%pa over the last 50 years. Aiming for high returns may be appealing to potential investors but if they are too ambitious and therefore not achievable, based on the investment strategy employed, then credibility and ultimately business may be at greater risk

- Realistic … an achievable return objective does not mean it is realistic; particularly over the long term. For example, a 10%pa return objective may be achievable in any one year across most asset classes, but in this world of low interest rates and historically high valuations, setting any expectation that a consistent 10%pa can be achieved is not realistic and is setting up for failure

- Time related … the more aggressive the return objective the more time may be required to achieve it due to the additional risk required. All investment objectives must be associated with a timeframe and rarely should that timeframe be less than 3 to 5 years unless dealing with lower risk strategies (such as conservative bonds)

More and more investment strategies are also including risk in their investment objectives. Risk can have multiple definitions, whether it is absolute (such as overall volatility) or relative (such as less risk than the S&P/ASX 200). It is worth noting that risk objectives should also follow the SMART principles as opposed to being vague, such as motherhood statements like, “low risk”.

Philosophy

The Investment Philosophy is an articulation of beliefs around what works and perhaps what doesn’t when it comes to investing. Investment markets are difficult to predict, highly competitive, and party to an array of beliefs and competing philosophies battle each other in the various markets with the goal of getting the best possible return.

The investment philosophy of a strategy or portfolio is typically what an investor is buying into. This is because the future is largely unpredictable so clear articulation of an Investment Philosophy can be a powerful client tool as well as setting guiding principles behind portfolio construction.

The Australian financial planning industry has embraced much of modern portfolio theory with core beliefs such as:

- Diversification … spreading your eggs across the various baskets which may be asset classes, investment styles, and at the security level, and

- Higher risk is required to achieve higher returns … hence there is the expectation that equities will outperform cash and bonds.

However, even these beliefs are challenged with strategies around increasing return potential from less diversification and more concentrated strategies. Then there is the market anomaly in certain markets that buying lower volatile securities having a tendency to outperform the more volatile or risky securities, which challenges the second belief around higher risk is required for higher return.

Irrespective of your belief around diversification and risk, the first question of philosophy typically comes down to a belief as to whether passive or active management is best, and whether it is applied to asset allocation, or security selection and in what asset classes.

Some of the more recent beliefs that are changing investment portfolios around the world include passive style investing (commonly called smart beta) and the re-embracing of skill as investors move away from traditional markets towards broader scope hedge fund-like strategies. On the flipside of this has been the biggest trend of all, which has seen enormous funds flow into passive market-cap index ETFs, suggesting many have stopped believing that active management can add value.

The best investment portfolios will have a clearly articulated investment philosophy which is understandable by investors, has evidence to support it, and is reflected in the chosen investments within. If an investor agrees with the investment philosophy, and the portfolio clearly reflects this, then investors are more likely to stay the course and are less likely to withdraw during the tough times that inevitably hit every investment portfolio.

Process

This is the portfolio construction process and leading to the ultimate design of the investment portfolio. It is designed to achieve the stated objectives, and reflects the stated investment philosophy or beliefs around what works in markets. An example of some of the questions to answer in the process design include:

- What is the investment universe?

- Which asset classes are included or excluded?

- Which securities or investment types are included or excluded?

- What is the expected return and risk of those asset classes or investments within the universe?

- Depending on methodology this question may also include the more complex relationship between asset classes or investments (e.g. correlation or covariance)

- What are the investment vehicles used to access the investment universe?

- This could relate to:

- Platform availability/limitations

- AFSL limitations such as limited products (managed funds, securities)

- What are the required hurdles to be placed in the final portfolio?

- Qualitative factors

- Philosophy, People, Process

- Quantitative factors

- Performance, risks, style, added value (past/expected)

- Research/Consultant ratings

- Expected returns and/or returns/risk

- Alignment with philosophy

- Cost budget

- Risk Budget

- Qualitative factors

- This could relate to:

The above is a relatively simple snapshot of some of the questions that could be answered to build the investment portfolio.

Most investment managers apply the above questions to a simple two-step portfolio construction approach:

- Asset Allocation, and

- Investment/Strategy selection

An investment philosophy with beliefs around market efficiency will lead towards passive index investing and beliefs of market inefficiency will bias strategies with various levels of non-market risk. Whilst this is relatively easy at the investment level, defining the “market” at the asset allocation level is rarely done and is often accepted as an industry average.

Investment objectives and philosophy will determine the type of process required which should also improve the efficiency of the design of the final investment portfolio. That said, implementing the investment process towards portfolio does require the greatest level of specialist investment expertise so its design should also consider capabilities of the key people involved.

Implementation

The execution or transaction of the investment portfolio is often one of the most overlooked components of the investment process. Considerations include:

- Cost of execution

- Buy/Sell spreads or brokerage can be significant return reducers irrespective of the quality of underlying assets that may reduce the ability to achieve objectives. This is particularly the case for high turnover strategies

- Managed account platforms may reduce costs of execution compared to other platforms when implementing complimentary strategies. For example, if one strategy is buying BHP whilst the other is selling BHP instead of 2 independent transactions there may be none or a reduced transaction savings numerous valuable basis points in cost

- Timely execution

- Portfolio return and risk expectations are made at a specific point in time and the time taken between the investment decision and time of execution may be costly

- Some investments, such as IPOs or various corporate actions, have deadlines, and if they are not addressed appropriately may also have costly implications.

- Rebalancing (which may also be part of Process)

- Establishing clear rules around rebalancing, whether it be at the asset class level, investment level, frequency (e.g. quarterly or annually), and/or movement from desired allocations (e.g. +/-10%) creates transparency and clarity for appropriate execution of the ongoing investment management of an investment portfolio

Overall, good portfolio implementation with clear rules can add return via the reduction of performance drag caused by poor implementation. When decisions are made to invest today based on today’s information, ideally investments are transacted today instead of adding the risk of short term market timing which has very little evidence of adding value. Implementation guidelines should not be taken for granted.

Ongoing Review

The one constant about investing is that nothing is constant. Markets go up and down, styles go in and out of favour, beliefs are constantly challenged, and every investment or investment manager underperforms their objectives or benchmarks at one time or another.

The ongoing review looks at the portfolio with typical outcomes focused on:

- Ensuring the portfolio is aligned to meet objectives and a reflection of investment philosophy

- Is the asset allocation appropriate?

- Capital market views and valuation considerations

- Investment and Performance review

- Are the investments doing what they are expected to do so?

- Are investments still satisfying required ratings?

- Are they invested according to stated styles?

- Are the drivers of portfolio returns and risks aligned with intentions?

The answers to these questions re-start the portfolio construction cycle leading to new portfolio recommendations (which may be to do nothing) and the cycle continues.

Whilst investment teams will consider portfolios on a daily basis, the formal review presented at the investment committee and typically on a quarterly basis. That said, the frequency of the formal portfolio review should depend on investment style and/or level of expected activity. Sometimes portfolio reviews are undertaken more frequently, and many are monthly. An example, may be during highly volatile times when market valuations fluctuate and potentially creating opportunity for the highly active strategy.

One of the challenges of the ongoing review is to avoid shot-termism. Changes in monthly or quarterly (or even annual) performance is often too short a timeframe to make a meaningful assessment of the potential success of an investment or portfolio of investments as styles that are out of favour today may be in favour tomorrow (and vice versa). It is typically best to keep an eye on the bigger picture issues such as ensuring the portfolio is a reflection of beliefs than persistent alpha (or outperformance) generation.

Conclusion

What this article provides is a starting point for those looking to improve the risk management of their investment business. The IPS is a key part of all successful investment management businesses from the largest Sovereign Wealth funds to the smallest boutique fund managers or advisory firms. Creating the rules of the investment game, with IPS, is a step in the right direction of good governance and risk management that is becoming even more crucial in these increasingly complex investment times.