One of the bigger frustrations for advisers is the lack of transparency of industry super funds. Advisers and researchers do not have deep access to their investment processes, often with little understanding as to what comprises an investment strategy beyond anything other than the asset allocation. As a result, in general advisers don’t recommend industry super funds as they struggle to satisfy the “know your product” part of their recommendations…there are exceptions and other reasons for recommending them, perhaps administrative efficiency, but advisers typically have concerns around the lack of transparency of investment risks.

Now not all Industry Super funds are completely lacking in transparency. For example Rest Super provide good detail of their long term historic performance as well as a list of investment managers that underlie each investment strategy/asset class…fantastic. This means for Rest Super we may be able to get some understanding of what risks may exist…a step in the right direction.

One of the prevalent asset class definitions among Industry Super funds is “Defensive Alternatives”…personally, I tend to think this term is an oxymoron. There is little doubt that alternative strategies can and do provide diversification benefits to a portfolio with the ability of increasing return potential whilst lowering portfolio risk. But on their own, I believe their alternative risks can rarely be relied on when you need them most…particularly when most alternatives are defined as Hedge funds, Private Equity, Commodities, or perhaps Property & Infrastructure.

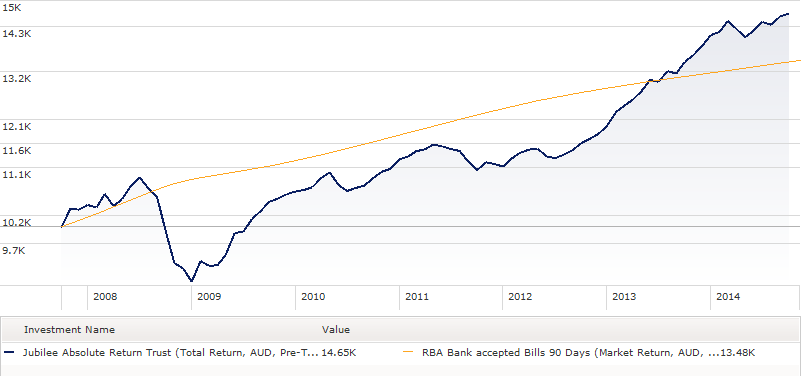

One of the strategies that is disclosed as part of Rest Super’s “Defensive Alternatives” is Jubilee Absolute Return Trust. Now its possible that Rest have a special mandate with Jubilee such that this investment is defensive, but when you consider the following performance chart of Jubilee versus cash and the near 20% drawdown towards the end of 2008, I’m pretty confident many would have a big question mark of its defensive status…certainly it wasn’t negatively correlated with risky assets during the worst of the GFC…and isn’t negatively correlation to risky assets what you want from a defensive investment???

Source: Morningstar Direct

Anyway, the key message is that you should never believe what an investment manager says and one person or firm’s definition of defensive may differ to someone else’s. The “Know your Product” requirement is an essential one for good financial advice and significant care must always be taken when providing advice on asset allocation alone. Of course, none of this means that the strategy won’t work moving forward…its just investing requires an understanding of risks and whether they are worth accepting.

For Rest Super, the “Defensive Alternatives” asset class as expected is not regarded as a growth asset class so their default Core strategy is self-classified as having 75% of growth asset instead of 84% if you include the 9% allocation of Defensive Alternatives…I’m sure most would agree 75% is quite aggressive, but 84% is a step up again…so Buyer Beware.

My personal hope is that one day, Industry Super funds will move to the levels of transparency that many of the larger retail managers have provided over the year. There is little doubt Industry Super funds do have high quality investment strategies worthy of recommendation by financial planners, but it is difficult to do so whilst there are doubts about “knowing the product”.

3 pings