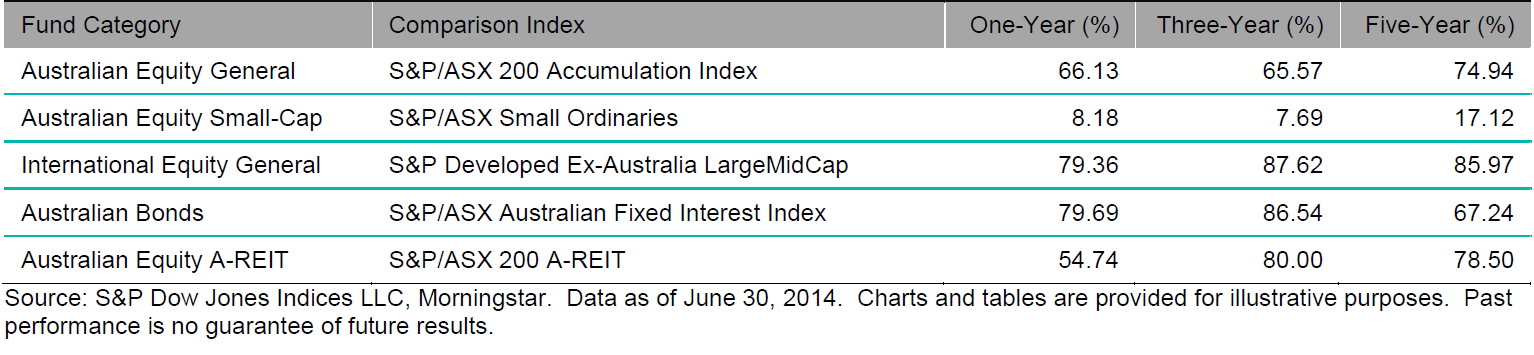

My favourite simple performance report on active management came out today on the Australian market…it can be downloaded by clicking here. Unfortunately active management for the broad asset classes once again came up looking poor with an overwhelming proportion failing to outperform broad indices for Australian Shares, International Shares, Australian REITs, and Australian Bonds. An enormous proportion of active managers were successful in outperforming their Small Cap Australian shares benchmark thus providing some support for the widely held belief that markets are a little less efficient in small cap land.

Anyway, if you don’t want to download the report the result I’m talking to just look at Table 1 below….

Table 1 – Percentage of Funds Outperformed by the Index

Source: SPIVA Australia Scorecard – Mid June 2014

Source: SPIVA Australia Scorecard – Mid June 2014

This report is one of my favourites because it takes survivorship bias into consideration…it does this by only surveying funds that were around at the start of the survey period, as opposed to those at the end of the period (which obviously leaves only the good ones). Its also worth pointing out that this is a survey of retail unit trusts so they clearly come with higher fees but lets face it, access to wholesale funds for almost everyone still has platform fees on top.

Of course retail index managers still may cost up to 90bps in these various categories (which is quite appalling in my humble opinion) and they are guaranteed to underperform so its not necessarily as compelling a case for index funds as it appears…but those 3 and 5 year numbers are pretty bad (except for small cap).

1 pings