The common criticism of market-cap weighted bond indices is that they are inefficient because they are obviously weighted towards those with the most debt. Thus indicating that the index potentially carries more risk than necessary, or than we may want in a portfolio, because those with the most debt carry greater default risk than those with very little debt.

Whilst there is definitely logic to this argument it is missing one essential ingredient…price. If those with the most debt are priced appropriately such that the price reflects all risks associated then any argument of inefficiency is irrelevent.

On the other hand, if there is mispricing it doesn’t mean a bond index fund is a bad place for investment or easily outperformed. Generally speaking, aside from lower fees, if the mispricing favours an overweight to the higher market cap securities then the index will be very hard to outperform given the high weighting towards the cheap assets. Active management has its best opportunity to outperform the index if the mis-pricing is such that the higher market cap securities are over-priced and given those securities are typically the most traded and therefore, in theory, most efficient then it still becomes a difficult task for the active manager to outperform the index.

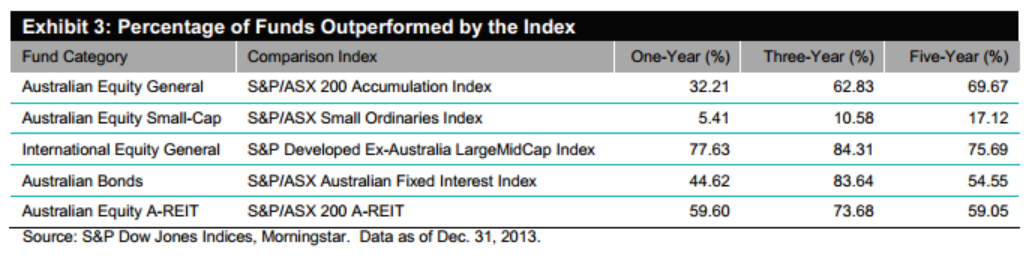

As a result it is not surprising that bond managers have significant difficulty in outperforming their market cap weighted benchmarks…despite the more frequent agreement among investment professionals that bond indices are more flawed than equity indices, See SPIVA table below…