One of my favourite reports has just been released, Credit Suisse Global Returns Yearbook. Aside from showing long term investment returns from the major exchanges around the world there are some fascinating articles on some of the latest thinking that relates to investment considerations. This year the articles are…

- The low return world

- Mean reversion, and

- Are equities a good inflation hedge.

A couple of the fascinating charts for me (and possible noone else) include…

China

Certainly the Chinese sharemarket has produced very poor real returns since the 1990s…so much for economic growth contributing to sharemarket growth.

World

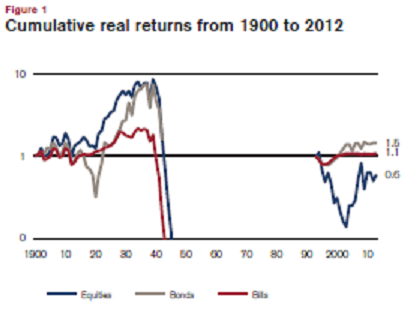

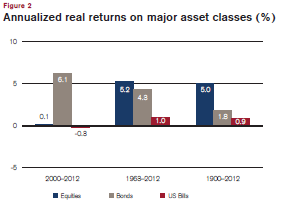

Over the last 112 years, shares have outperformed bonds by only 3.2%pa…that certainly compounds to a massive difference but I’m guessing its way below the expected outperformance many advisers or clients expect to receive for accepting the additional sharemarket risk. Oh yeah, and I’m being positive from this graph because over the last 50 years that outperformance was only 0.9%pa … albeit bonds have had a great run which I’m very confident cannot continue for the next 50 years.