I am a little amazed at how many articles across the newspapers of Australia have suggested that residential house prices are going to go through the roof given the latest interest rate reduction from the RBA. The chart below shows that house prices have declined over the last couple of years or so, but somehow its the latest cut that will send prices upwards.

Source: RBA

I thought I’d do some smple mathematics to determine how much a 0.25% interest rate reduction improves the borrowing capacity. So to keep it simple, if someone had the capacity to borrow $400,000 last month (before the interest rate decrease), then assuming their ability to make principle and interest payments is unchanged, the interest rate reduction of 0.25% (and we know not all banks have passed this on), only increases their borrowing ability to a little over $410,000 for a thirty year loan…or around 2.5%…so the impact on the above chart should be no mroe than what statisticians call noise.

The bottom line for the rate cut is in Glenn Stevens conclusion when he said,

the growth outlook for next year looked a little weaker

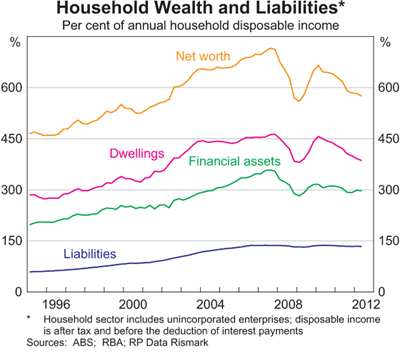

Hopefully the interest rate reduction improves the outlook for growth, but its very difficult to see too much increase in housing prices until there is improvement in the household balance sheet. The following chart shows that household asset values have declined whilst our debt levels have stayed roughly the same…with savings rates continuing near double digit levels (see final chart), as a nation we are largely in deleveraging mode and I’m confident that will continue for a little longer whilst debt levels continue to be near the highest levels in the world.

Maybe I’ll be wrong but if I am wrong about house prices, I can only imagine our household debt levels will be at truly frightening levels.

Source: RBA