Source: RBA, Delta Research & Advisory

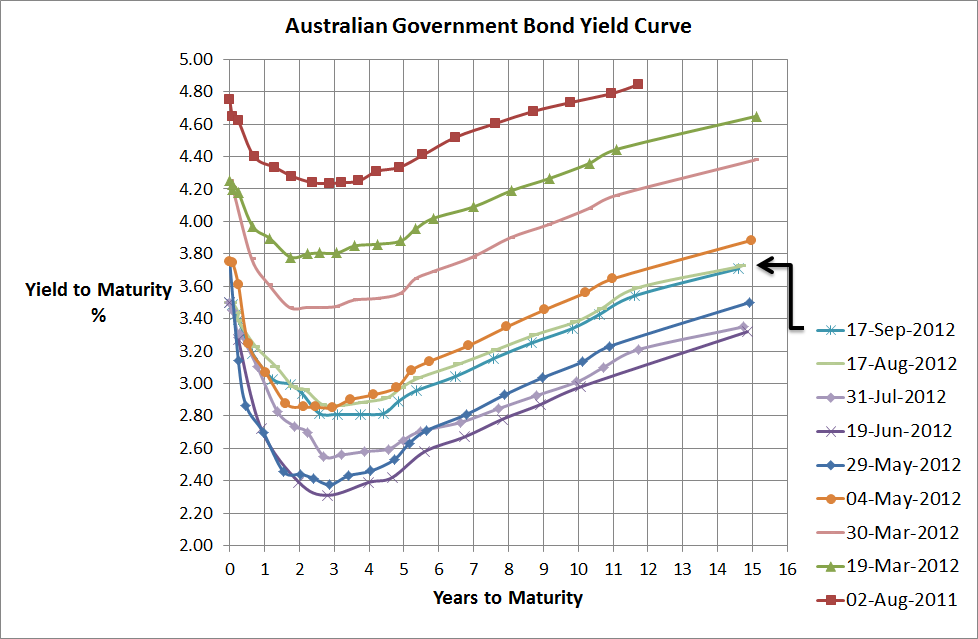

Bizaarely as it seems but the above chart shows that over the last month the Australian Government Bond Yield curve has barely budged. There’s really no more than 5 to 10 bps difference across all terms and when you consider the various big announcements, economic results from here, overseas and the sharemarket increase over the same period (S&P/ASX200 up by around 4.3%) you would have thought some type of change would have flowed through.

Ben Bernanke’s QE3 announcement has helped risky assets around the world as expectations that investment banks and banks will be allowed to freely speculate (lets face it Ben’s really helping the banks more than the unemployed) and Draghi’s bond buying plan certainly saves the Euro in the short term. Other big issues have been China’s slowdown and the reduction in commodity prices (although a small rebound recently). So there probably hasn’t been a great deal of high quality bond selling for the purposes of investing in shares or risky assets and its probably more the central banks are allowing bad collateral to be used to convert to cash so there hasn’t been much need to sell the good collateral.

Overall, I don’t have a great to say that’s different from the past. There are still some macro risks, bond prices have poor long term value but are sill likely to be the best hedge to equity market volatility. I do believe equity market volaitlity is likely to increase and that is the best investment call I can think of (not so easy to implement…nor is at advice for anyone to implement). Term Deposits are still paying 200-250bps higher than government debt for similar risks so look good value. Credit risks look pretty good compared to the past but are correlated with equities so are potentially a moor portfolio diversifier. Residential property will continue to be under pressure whilst Australians continue to deleverage their frightening balance sheets which are amongst the most leveraged in the world. A-REITs and Global REITs are still a concentrated wild ride and anyone’s guess…I prefer to diversify a little more. Aussie dollar…still looks too high…I could be saying that for a while though. Hedge funds and other alternative strategies may provide potential but I must caution any retail investor against investing in vehicles they don’t understand and lack transparency…let’s face it the past doesn’t equal the future so last year’s great performer is rarely this years. Hybrids are trendy again as the chase for yield continues but there are some pretty bad conditions associated with them…60 year terms…give me a break!

A fairly random rambling from me today so I thank you if you’ve managed to read this far!