My new company, Delta Research & Advisory, has recently conducted some risk factor analysis of Australian fund managers and it is starting to yield some interesting results. We’ve analysed around 120 managers using Fama/French-like risk factors where thhe value/growth factor is simply MSCI Australian Value index minus MSCI Australia Growth index and the Size factor is MSCI Australia Small Companies minus MSCI Australia Large companies.

Using the outputs of the analysis we were able to re-classify (I say re-classify because the results showed different classifications to Morningstar across both factors) each fund to Value, Neutral, and Growth styles plus Small, Neutral, Large cap biases…these biases were calculated relative to the broader index funds from BlackRock, Vanguard, State Street, and Macquarie.

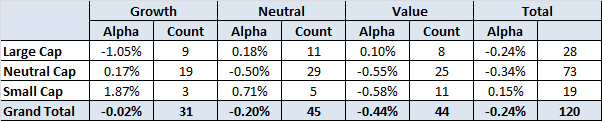

One of the outputs from the analysis is also the level of risk-adjusted alpha (or skill) each manager possesses and whilst I’ve performed the analysis over 5, 7, and 10 years the resultsthe table below shows results from the larger 5 year analysis. Anyway, the style versus skill output came out as follows…

Source: Delta Research & Advisory

I haven’t performed any signifcance testing so my conclusions may be a little enthusiastic, but either way, the numbers show that potentially Growth (& to a lesser degree Neutral) Managers only have skill (alpha) in Small cap land (albeit a very small sample size) and Value Managers only have skill in Large Cap land. Perhaps this may be the start of evidence that produces another way of assessing managers…not sure yet…but the results are potentially quite fascinating (at least for a quant geek like me).

Now the more perceptive of you might say that these alpha/skill results are simply the output of their style biases…that is, Growth managers being successful in small cap land is due to the fact that they are growth managers…my response is that the alpha results produced have already taken style bias into consideration. The alpha we have calculated is representative of the skill that is left after the growth/value and small cap style effects are removed. Therefore alpha is independent of style.

I kow that last paragraph is probably so full of quant geek talk that I’ve lost you but trust me when I say the results have all biases removed and my previosuly stated (potential) conclusion remains…

If you ‘re going to invest in Small Caps it “may” be better to choose a Growth Manager and if you’re going to invest in Large Caps it may be better to choose a Value Manager or perhaps not a Growth manager…pending further statistical analysis 🙂