I know I’m a day late with this but anyway… like everyone I was absolutely shocked at the sensational GDP result that came out yesterday. Since August last year the bond market has been moving in a direction that indicates our economy is not what it seems but nevertheless the 12 months to March 2012 shows real GDP in excess of 4%…truly amazing. Now I know the bond market has been bought up by a massive number of foreign investors but the shape of the yield curve doesn’t lie, and its been short term negative signalling some type of weakness.

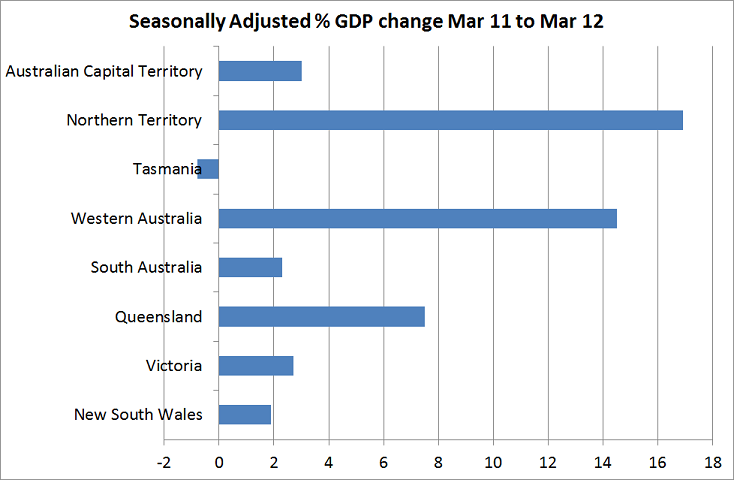

But despite the great national result, when you break it down there are clearly significant pockets of weakness. The biggest driver of the GDP result is thanks to the resources sector and when you look at the state’s results, it supports this fact but it also shows that our GDP growth as a nation is really only driven by 2 states…Queensland and Western Australia…I guess Northern Territory too but its quite small in comparison.

Source: Australian Bureau of Statistics

As you can see, Queensland, Western Australia and Northern Territory really shot the lights out with the latter two showing double digit growth. Also, Queensland would have received significant growth hit from the flood and cyclone rebuild so there is a (hopefully) one-off impact in there that shouldn’t be forgotten.

If you look at the other states…nothing too flash. Tasmania is in recession and our two biggest states by population, NSW and Victoria, have growth only around 2%,give or take…in fact NSW was negative for the quarter.

So our economy, has definitely been reliant upon our resources sector for economic growth. Despite that, the resource sector has been a laggard in our sharemarket…why so? Well the sharemarket is a forward looking or leading indicator and I guess the sharemarket is forecasting that China’s growth is slowing and things aren’t quite as rosy for resources as they once were…do’t get me too wrong…its still relatively rosy…but its all relative and the outlook for resource profit has diminished.

Anyway, the multi-speed economy is stil in play and the RBA didn’t drop rates for the wrong reason last Tuesday…it dropped them because

the Board judged that, with modest domestic growth and a weaker and more uncertain international environment, the outlook for inflation afforded scope for a more accommodative stance of monetary policy